To no one's surprise, the Bank of Canada left its target

overnight rate unchanged at 1/2 percent. The Bank, however, reduced its forecast

for the global economy and for the U.S. economy as well, suggesting that the

outlook for Canadian exports is less favorable than earlier forecast. (Table 1

below shows the Bank's current global forecasts with the January fo recasts in

parentheses.)

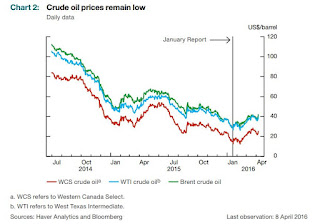

While oil prices are off their lows and slightly above

the level forecast by the Bank in January, the central bank now expects deeper

cuts in oil sector business investment. The Bank expects crude oil prices to

remain low (Chart 2). The Canadian dollar has increased sharply from its lows

earlier this year, "reflecting shifting expectations for monetary policy

in Canada and the United States, as well as recent increases in commodity

prices." The loonie has surged 15% in less than three months to its

strongest level in since mid-2015. This, of course is bad news for exports, and

the Bank played down the outlook for Canadian growth in its policy statement

and Monetary Policy Report (MPR).

The Bank suggested the surprising strength in the first

quarter is in part due to temporary factors and will reverse in the second

quarter. Their estimate of output growth in the first quarter is now 2.8%,

below consensus private-sector estimates of 3+%, slowing to 1% output growth in

the second quarter. The Bank re-emphasized that the structural adjustment to

the decline in oil prices is ongoing and will dampen growth over the next three

years. This is a more pessimistic, but realistic view than the Bank took a year

ago.

The Bank's forecast for growth this year and next is

significantly less optimistic than many market watchers expected, especially in

light of the recent strengthening in the employment and monthly GDP data. The

Bank's Governing Council suggested that had it not been for the recent budget's

fiscal stimulus, the growth outlook would have been revised down from the

January outlook. Including the effects of the budgetary easing, the Bank now

forecasts Canadian growth this year at 1.7%, next year at 2.3% and and 2.0% in

2018. Slower foreign demand growth, the higher Canadian dollar and a downward

revision to business investment all have negative impacts on the outlook but

are more than offset by the positive effects of the fiscal measures announced

in the federal budget in March.

The Bank of Canada also revised down its estimate of

potential growth in the economy to roughly 1.5%, mainly reflecting slower

growth in trend labour productivity as a result of weaker investment. The new

growth profile, combined with the revised estimate for potential, suggests the

output gap could close somewhat earlier than the Bank had anticipated in

January, likely in the second half of 2017. Inflation is expected to remain at

or below the target rate of 2%.

Bottom Line: Caution is the watchword for today's Bank of

Canada policy report.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres