The number of new listings of homes for sale on the Multiple Listing Service® (MLS®) of all real estate Boards in Canada set a new record in July 2008, according to MLS® statistics released by The Canadian Real Estate Association (CREA).

New MLS® residential listings numbered 80,147 units in July 2008, up 1.4 per cent from the previous month and 0.5 per cent above the previous record set in May 2008. This is the first time in any month that new listings surpassed eighty thousand units.

The number of new listings scaled to new heights in Ontario and Quebec, and in Manitoba climbed to their second-highest level since the beginning of the new millennium. This more than offset a monthly decline in the number of new listings in Alberta, where levels continue retreating from the peak reached in March.

Seasonally adjusted national sales activity in July 2008 was stable compared to the previous month. It has been holding steady since posting a 6.0 per cent month-over-month decline in February. Monthly activity rose in Alberta, Nova Scotia and Prince Edward Island for the second time in as many months. Activity also rose on a month-over-month basis in Newfoundland & Labrador. The monthly increase in activity in these provinces was offset by a monthly decline in activity in British Columbia, Ontario, and Quebec.

Sales activity set a new monthly record in Manitoba, and in Newfoundland & Labrador. It also climbed to its highest point on record for the year-to-date in these provinces.

Resale housing market balance is represented by sales as a percentage of new listings. The continuing rise in the number of new listings is resulting in a considerably more balanced resale housing market this year than buyers faced last year. This trend is most apparent in British Columbia and Saskatchewan, which remained the most balanced provincial markets in July. The market is showing signs of stabilizing in Alberta, where new listings have declined and market balance has tightened in each of the months from April to July 2008.

The national MLS® residential average price eased by 2.4 per cent year-over-year in July 2008, compared to the average price decline of 3.6 per cent in the major markets in Canada reported by CREA earlier this month. The MLS® price decline reflects softening average prices in Alberta and an increase in the province’s share of national sales activity compared to year-ago levels. By contrast, residential average price climbed to its highest level for the month of July in all other provinces except British Columbia, and its highest level ever in Newfoundland & Labrador. Average price for the year to date (as of July 2008) is 2.7 percent above where it stood over the same period last year.

Seasonally adjusted dollar volume for MLS® sales totaled $11.8 billion in July 2008, climbing to the highest level ever in Manitoba and Nova Scotia. It also reached the highest level on record for the month of July in Quebec, New Brunswick, and Newfoundland & Labrador. Volume for the year to date in July also achieved the second highest level on record, down 16.6 per cent from the peak last year.

"To keep things in perspective, 2007 was a record year for MLS® sales in Canada," says the President of The Canadian Real Estate Association, Calvin Lindberg. "The fact that sales volume continue at levels so close to that record year indicates what a dynamic and active real estate market there is in many regions of the country."

"The other factor is that the more listings there are on the market, the bigger the impact on the average price," the CREA President adds. "It means a market when buyers have more options, and sellers must be realistic in their pricing expectations. A REALTOR® has expertise and marketing resources to help both."

"The trend for new listings generally reflects recent price trends," said CREA Chief Economist Gregory Klump. "While still elevated, new listings in Alberta are easing and market balance is stabilizing now that prices there have softened. Similar trends are expected to play out in other western provinces where prices posted sharp gains last year," he said.

“Copyright British Columbia Real Estate Association. Reprinted with permission.” August 29, 2008

Nelson BC real estate blog by Robert Goertz of Valhalla Path Realty. Keeping you up to date with the Nelson and West Kootenay real estate markets.

Friday, August 29, 2008

Monday, August 18, 2008

An Excellent Time to Buy or Sell

By incorporating the right strategy this is still an excellent time to buy or sell a home. I make this statement despite the fact that recent stats are definitely showing that the market has slowed. After all the Kootenay Real Estate Board has just reported a 69% increase in current inventory. The result of a 33.8% slow down in sales and and a 24.8% increase in the number of listings.

But the future is not as bleak as it appears. Our adjusting real estate market is not a disaster. This correction is needed to help create a healthier, balanced market.

For Sellers current market conditions simply means that they must price their home right. Sellers must accept that their house will not sell for as much as it would have last year and that to influence a quick sale, the really anxious seller may even have to further reduce the price. Properties are now taking longer to sell. Pricing a property correctly is still the best way to reduce the stress of selling.

In addition to selecting an appropriate asking price, the condition of the property is key to achieving the quickest sale for the highest price and most favorable terms. Staging is now more critical then in previous years when a house in any condition would sell quickly just because there was nothing else available. Today sellers need to remove clutter and make repairs. A well maintained and well presented home will out sell the properties where work has been deferred. The balance of power has levelled but sellers still maintain control of the condition and price of a property.

For buyers the new market conditions provides them with the time that they need to make an informed decision. I never enjoyed having to say to a buyer, "if you like this house you will need to act quickly, by tomorrow it will likely be sold." But that was the reality of the 2005-2007 Nelson, BC real estate market.

The reality for buyers in 2008 is no pressure to compete, an increase in supply and time to consider a purchase rationally. Now is the time for buyers to seriously consider purchasing a home.

But the future is not as bleak as it appears. Our adjusting real estate market is not a disaster. This correction is needed to help create a healthier, balanced market.

For Sellers current market conditions simply means that they must price their home right. Sellers must accept that their house will not sell for as much as it would have last year and that to influence a quick sale, the really anxious seller may even have to further reduce the price. Properties are now taking longer to sell. Pricing a property correctly is still the best way to reduce the stress of selling.

In addition to selecting an appropriate asking price, the condition of the property is key to achieving the quickest sale for the highest price and most favorable terms. Staging is now more critical then in previous years when a house in any condition would sell quickly just because there was nothing else available. Today sellers need to remove clutter and make repairs. A well maintained and well presented home will out sell the properties where work has been deferred. The balance of power has levelled but sellers still maintain control of the condition and price of a property.

For buyers the new market conditions provides them with the time that they need to make an informed decision. I never enjoyed having to say to a buyer, "if you like this house you will need to act quickly, by tomorrow it will likely be sold." But that was the reality of the 2005-2007 Nelson, BC real estate market.

The reality for buyers in 2008 is no pressure to compete, an increase in supply and time to consider a purchase rationally. Now is the time for buyers to seriously consider purchasing a home.

Kootenay Real Estate Board Stats July 2008

Sales were down 31% over last year, Year to Date overall sales are down 33.8%.

Listing numbers in July were up 17% over last year, Year to Date listing numbers are up 24.8%.

Listing Inventory is up 69% over last year at the end of July.

Listing numbers in July were up 17% over last year, Year to Date listing numbers are up 24.8%.

Listing Inventory is up 69% over last year at the end of July.

Swollen Inventories Favour Homebuyers

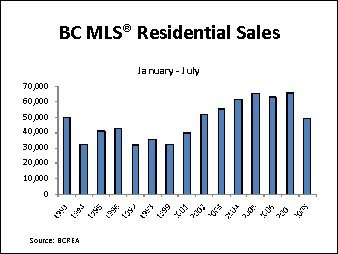

British Columbia Real Estate Association (BCREA) reports residential sales dollar volume on the Multiple Listing Service® (MLS®) in BC declined 38 per cent to $2.9 billion in July, compared to July 2007. Residential unit sales fell 37 per cent to 6,541 units during the same period. The average MLS® residential price in the province was $444,358, down 0.5 per cent from July 2007. “Home sales have slowed to a level not seen since the beginning of the decade,” said Cameron Muir, BCREA Chief Economist. “BC households are now cautious about making major purchases in light of uncertainty around fuel prices and other inflationary pressures.”

“The slowdown in housing demand has swollen the inventory of homes for sale, putting downward pressure on home prices in some markets,” added Muir. A total of 60,008 homes were for sale on the MLS® in July, an increase of 63 per cent from the previous year. “While this inventory is expected to decline in the coming months, most BC regions will remain in buyers’ market territory for the remainder of 2008.”

Year-to-date MLS® residential sales dollar volume in the province declined 18 per cent to $23.2 billion compared to the same period last year. Sales transactions fell 24 per cent to 49,448 units, while the average residential price increased 8.2 per cent to $469,676 over the same period.

“Copyright British Columbia Real Estate Association. Reprinted with permission.” August 15, 2008

“The slowdown in housing demand has swollen the inventory of homes for sale, putting downward pressure on home prices in some markets,” added Muir. A total of 60,008 homes were for sale on the MLS® in July, an increase of 63 per cent from the previous year. “While this inventory is expected to decline in the coming months, most BC regions will remain in buyers’ market territory for the remainder of 2008.”

Year-to-date MLS® residential sales dollar volume in the province declined 18 per cent to $23.2 billion compared to the same period last year. Sales transactions fell 24 per cent to 49,448 units, while the average residential price increased 8.2 per cent to $469,676 over the same period.

“Copyright British Columbia Real Estate Association. Reprinted with permission.” August 15, 2008

Monday, August 11, 2008

Housing Starts Down in July

The seasonally adjusted annual rate of housing starts was 186,500 units in July, down from 215,900 units in June, according to Canada Mortgage and Housing Corporation (CMHC).

“After a strong first half of the year, the volatile multiple segment is now readjusting itself.” said Brent Weimer, Senior Economist at CMHC’s Market Analysis Centre. “This brings activity since the start of the year closer in line with our 2008 forecast of more than 200,000 housing starts for the seventh consecutive year.”

The seasonally adjusted annual rate of urban starts decreased by 14.8 per cent in July compared to June. Both urban multiples and singles moved down, with a drop of 20.2 per cent for multiples to 91,600 units, and a 6.6 per cent decline for singles to 69,800 units.

The seasonally adjusted annual rate of urban starts went down in Ontario and to a lesser extent in the Prairies, where housing starts decreased by 38.8 per cent to 47,800 and by 1.6 per cent to 30,600 in July, respectively. Urban starts increased slightly by 2.2 per cent to 41,200 units in Quebec, by 2.4 per cent to 8,700 units in Atlantic Canada, and by 5.1 per cent to 33,100 units in British Columbia. While single starts decreased in all regions in July, with the exception of the Atlantic Canada where they remained unchanged, multiple urban starts only registered a decline in Ontario.

Rural starts were estimated at a seasonally adjusted annual rate of 25,100 units in July2.

For the first seven months of 2008, actual starts in rural and urban areas combined were up an estimated 2.3 per cent compared to the same period last year. Year-to-date actual starts in urban areas have increased by an estimated 2.4 per cent over the same period in 2007. Actual urban single starts for the January to July period of this year were 15.5 per cent lower than they were a year earlier, while multiple starts were up by 19.0 per cent over the same period.

CMHC OTTAWA, August 11, 2008

“After a strong first half of the year, the volatile multiple segment is now readjusting itself.” said Brent Weimer, Senior Economist at CMHC’s Market Analysis Centre. “This brings activity since the start of the year closer in line with our 2008 forecast of more than 200,000 housing starts for the seventh consecutive year.”

The seasonally adjusted annual rate of urban starts decreased by 14.8 per cent in July compared to June. Both urban multiples and singles moved down, with a drop of 20.2 per cent for multiples to 91,600 units, and a 6.6 per cent decline for singles to 69,800 units.

The seasonally adjusted annual rate of urban starts went down in Ontario and to a lesser extent in the Prairies, where housing starts decreased by 38.8 per cent to 47,800 and by 1.6 per cent to 30,600 in July, respectively. Urban starts increased slightly by 2.2 per cent to 41,200 units in Quebec, by 2.4 per cent to 8,700 units in Atlantic Canada, and by 5.1 per cent to 33,100 units in British Columbia. While single starts decreased in all regions in July, with the exception of the Atlantic Canada where they remained unchanged, multiple urban starts only registered a decline in Ontario.

Rural starts were estimated at a seasonally adjusted annual rate of 25,100 units in July2.

For the first seven months of 2008, actual starts in rural and urban areas combined were up an estimated 2.3 per cent compared to the same period last year. Year-to-date actual starts in urban areas have increased by an estimated 2.4 per cent over the same period in 2007. Actual urban single starts for the January to July period of this year were 15.5 per cent lower than they were a year earlier, while multiple starts were up by 19.0 per cent over the same period.

CMHC OTTAWA, August 11, 2008

Subscribe to:

Posts (Atom)