Decelerating inflation and a slowing economy had the Bank of Canada discussing, but ultimately deciding against, a rate cut earlier this week. However, it is unlikely that the Bank will act to offset mortgage restrictions introduced by the Federal government unless the outlook for growth inflation becomes dramatically weaker.

Nelson BC real estate blog by Robert Goertz of Valhalla Path Realty. Keeping you up to date with the Nelson and West Kootenay real estate markets.

Monday, October 24, 2016

Canadian Consumer Price Inflation - October 21, 2016

Decelerating inflation and a slowing economy had the Bank of Canada discussing, but ultimately deciding against, a rate cut earlier this week. However, it is unlikely that the Bank will act to offset mortgage restrictions introduced by the Federal government unless the outlook for growth inflation becomes dramatically weaker.

Bank of Canada Interest Rate Announcement - October 19, 2016

There is downside risk to the economy given the Federal Government's decision to tighten mortgage credit this month, though it will take some time to see the effects on economic growth. That said, even if growth moderates as a result of the housing policy changes, the Bank of Canada's public support for that policy likely means interest rates would not be lowered in response. With growth recovering from a second quarter contraction and inflation still tame, We therefore expect the Bank to leave rates unchanged for the foreseeable future.

Canadian Manufacturing Sales - October 18, 2016

In BC, where the manufacturing sector employs approximately 170,000 people and is a key driver of economic growth, sales were sharply higher for a second consecutive month, rising 2.1 per cent on a monthly basis and 8.1 per cent year-over-year. The gains continue to reflect a strong rebound in the forestry sector, with shipments of wood products rising at a double digit pace year-over-year. Given strong manufacturing sales in August the BC economy remains on track to expand by a Canada leading 3.5 per cent in 2016.

BC Home Sales Reflect Regional Demand Variations

Canadian Housing Starts - October 11, 2016

Looking at census metropolitan areas (CMA) in BC, total starts in the Vancouver CMA were up 110 per cent year-over-year in September, led by triple digit growth in both single and multiple units. In the Victoria CMA, housing starts tripled compared to September 2015 due to strong growth in new multiple unit starts. New home construction in the Kelowna CMA rose 16 per cent on balanced growth between single and multiple unit starts. Housing starts in the Abbotsford-Mission CMA declined 64 per cent compared to last year as multiple unit projects took a breather in September following several strong months of activity.

Canadian Building Permits - October 6, 2016

After two straight monthly declines, total permit activity in BC was up 15.9 per cent in August, once again surpassing $1 billion in total value. The gains were almost exclusively due to higher construction intentions for multiple family dwellings. Those gains more than offset a 7.7 per cent monthly decline in non-residential permits. On a year-over-year basis, the dollar value of building permits in the province were up 4.5 per cent.

Construction intentions were higher in most of BC's four census metropolitan areas (CMA). Permits in the Abbotsford-Mission CMA surged 249 per cent from July to August but were down 7 per cent year-over-year while the Vancouver CMA saw a 15 per cent increase on a monthly basis but a 12 per cent drop year-over-year. In the Kelowna CMA, permits fell 13 per cent from July but were up 67 per cent year-over-year. In Victoria, construction intentions rose 9.3 per cent on a monthly basis, and were 58.5 per cent higher than in August 2015.

Millennials Bear Brunt of Fed Policy Changes

- A family with an annual household income of $80,000 and a 5 per cent down payment will see their purchasing power fall from $505,000 to $405,000 (-$100,000). i

- An individual with an annual income of $60,000 and a 5 per cent down payment will experience a reduction of purchasing power from $380,000 to $305,000 (-$75,000).

- A household earning $120,000 per year and a 10 per cent down payment will see a reduction in purchasing power from $803,000 to $651,000 (-$152,000).

- Housing demand will slow as millennials, other first-time and early move-up buyers are squeezed out of the market.

- This reduction in demand may cause imbalances and declining prices across some product types in some communities. In addition, new home construction activity will lag along with related employment and economic growth.

- Pent-up demand will intensify, contributing to another cycle of rapidly rising prices in the future as financially retrenched millennials buy up an undersupplied housing stock.

Federal Government Changes to Mortgage Insurance Rules - October 3, 2016

With this move, the Federal Government has chosen to offset a modest risk to the taxpayer by severely eroding affordability for low equity home buyers, particularly first time home buyers. The qualifying rate is updated weekly and available on the Bank of Canada website. It is currently 4.64 per cent, about 200 basis points higher than the best bank offered rates.

To qualify for mortgage insurance, a homebuyer's debt servicing ratio must be no higher than:

The Federal Government is also instituting new eligibility rules for low-ratio (higher than 20% down payment) mortgages backed by government insurance. As of November 30, 2016, to be eligible for government insurance, new mortgages must meet the following requirements:

Canadian Monthly GDP (July 2016) - September 30, 2016

While some downside risks remain, particularly due to highly leveraged Canadian households, we expect Canadian economic growth will rebound sharply in the third and fourth quarter as oil production normalizes and the federal government's uptick in expenditures and tax credits impacts the economy. The Canadian economy is forecast to expand more than 3 per cent in the third quarter of this year before leveling off to an average of 2.5 per cent in the second half into 2017.

Canadian Housing Starts - August 9, 2016

Looking at census metropolitan areas (CMA) in BC, total starts in the Vancouver CMA were down 9 per cent year-over-year in July, dragged down by a 14 per cent decline in multiple unit starts. Single-detached starts in the Vancouver CMA were up 15 per cent. In the Victoria CMA, housing starts continue to climb, more than doubling year-over-year on strong growth in new multiple unit starts. New home construction in the Kelowna CMA rose 9 per cent as a result of 13 per cent growth in multiple unit starts. Housing starts in the Abbotsford-Mission CMA were up 25 per cent year-over-year, as a surge in single unit construction outweighed a decline in multiple units.

Thursday, August 25, 2016

Record BC Home Sale Forecast Despite Vancouver Slowdown: BCREA 2016 Third Quarter Housing Forecast Update

Thursday, August 18, 2016

Housing Market Slows to a Simmer in BC

Thursday, July 14, 2016

Tight Market Conditions Prevail Around the Province

Wednesday, June 15, 2016

Record Home Sales Creates Wave of New Home Construction

The British Columbia Real Estate Association (BCREA) reports that a record 13,458 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May, up 32.3 per cent from the same month last year. Home sales last month exceeded April’s record of 12,969 units. Total sales dollar volume was $9.72 billion in May, up 51.1 per cent compared to the previous year. The average MLS® residential price in the province was up 14.2 per cent year-over-year, to $722,146.

“Record housing demand and dwindling inventories are continuing to push home prices higher in most BC regions,” said Cameron Muir, BCREA Chief Economist. “Total active residential listings across the province are nearly 30 per cent lower than twelve months ago.“

“New home construction activity is at a near record pace in the province,” added Muir. In the Metro Vancouver market, a record number of homes are now under construction. “Once the current crop of homes are ready for occupancy there will likely be more selection for home buyers and less upward pressure on home prices."

Year-to-date, BC residential sales dollar volume increased 62 per cent to $41 billion, when compared with the same period in 2015. Residential unit sales climbed by 35.2 per cent to 54,455 units, while the average MLS® residential price was up 19 per cent to $752,105.

Copyright BCREA - reprinted with permission

Wednesday, May 25, 2016

Bank of Canada Interest Rate Announcement

Friday, May 13, 2016

Nelson, BC Single Family Home Sales

BC Home Sales Continue to Smash Record Book

Copyright BCREA - reprinted with permission

Tuesday, May 10, 2016

Contract Changes Benefit Real Estate Consumers

Canadian Housing Starts

Thursday, April 28, 2016

Current Market Conditions

Here is a look at the numbers..

- the sell to list ratio is up from 95.53% to 97.99%,

- the average days on market is down from 172 to 138

- the total sales is up from $6,824,250 to $8,826,900

- and the number of new listings is down from 41 to 25!

Source: KREB Area Detailed Summary March 2016 year over year Nelson Residential Sales Stats

Friday, April 15, 2016

Bank of Canada Cautious About the Outlook

Chief Economist, Dominion Lending Centres

Canadian Manufacturing Sales

BC Home Sales Post All Time Record

Bank of Canada Interest Rate Announcement

Friday, April 8, 2016

Canadian Employment

Thursday, April 7, 2016

Canadian Building Permits

The total value of Canadian building permits climbed 15.5 per cent on a monthly basis in February. That increase follows a 9.5 per cent decline in the previous month. Stronger permits were driven by higher construction intentions in the commercial sector in Alberta as well as single-family residential permits in Ontario.

In BC, total permit activity declined in February, dropping 1.2 per cent on a monthly basis but remained above $1 billion for the fourth consecutive month. On a year-over-year basis, the dollar value of building permits in the province was 11.5 per cent higher than February 2015. Non-residential permits were up 17.1 per cent on a monthly basis and close to 54 per cent year-over-year while residential permits were down 8.3 per cent on a monthly basis and were 1.8 per cent lower compared to last year.

Construction intentions were mostly lower in BC's four census metropolitan areas (CMA). Permits in the Abbotsford-Mission CMA were down 43 per cent on a monthly basis and 13.8 per cent lower year-over-year. In the Kelowna CMA, permits fell 63 per cent from January but were 65 per cent lower year-over-year. In the Vancouver CMA, permits fell 5.5 per cent on a monthly basis and were essentially flat year-over-year. In the Victoria CMA, permit activity was up 94 per cent on a monthly basis and more than doubled on a year-over-year basis.

Copyright BCREA - reprinted with permission

Sunday, April 3, 2016

Canadian Monthly GDP

The Canadian economy got off to a fast start in 2016 as real GDP expanded 0.6 per cent in the month of January, the fourth consecutive monthly increase. Output was led higher by gains in the manufacturing, oil and gas extraction, retail trade and finance industries. Given the strong start to the quarter, economic growth is tracking at a more than 3 per cent rate for the first quarter.

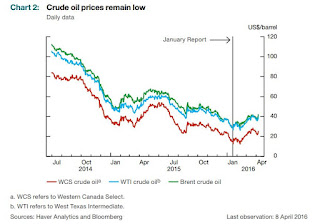

The Canadian economy grew just over 1 per cent for all of 2015 and so the strong start to the year is a welcome turn of events. However, with oil and other commodity prices still low, it is too early to say whether 2016 will see continued strong growth. That said, we do anticipate a stronger economy this year, helped along by a strengthening US economy, a low dollar and fiscal stimulus that should start having an effect during the second half of 2016.

Copyright BCREA - reprinted with permission

US Employment

US Non-farm payrolls increased for a record 73rd consecutive month in March, rising by 215,000 jobs. The US unemployment rate edged slightly higher to 5 per cent. Over the past three months, the US economy added an average of 209,000 jobs per month.

The US economy is steadily growing and producing jobs at a good but not spectacular pace. Wage growth is low but seems to be increasing and inflation remains muted. All in all, there is still not much of a case of more aggressive tightening by the US Federal Reserve which should help keep Canadian bond yields and therefore mortgage rates low.

Copyright BCREA - reprinted with permission