Nelson BC real estate blog by Robert Goertz of Valhalla Path Realty. Keeping you up to date with the Nelson and West Kootenay real estate markets.

Monday, September 30, 2013

Canadian Monthly GDP Growth

The Canadian economy bounced back from a flood and labour unrest induced 0.5 per cent decline in June to grow 0.6 per cent in July. Growth was led by those industries hardest hit in the previous month, including construction, manufacturing and oil and gas.

The rebound in July's economic growth provides some momentum for the economy in the third quarter. Our tracking estimate currently puts third quarter Canadian economic growth at roughly 2 per cent. However, growth in the third and fourth quarter may be challenged by yet another manufactured debt crisis in the United States as well as the impact of higher long-term interest rates. While the latter have moderated significantly since the US Federal Reserve opted not to slow its quantitative easing, rates could rise quickly if US economic data exceeds expectations. Our forecast for the Canadian economy in 2013 remains at 1.6 per cent real GDP growth.

Copyright BCREA - reprinted with permission

Wednesday, September 25, 2013

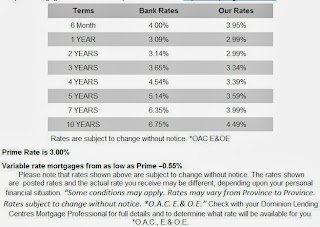

Mortgage Rates

Please note that rates shown above are subject to change without notice. The rates shown are posted rates and the actual rate you receive may be different, depending upon your personal financial situation. “Some conditions may apply. Rates may vary from Province to Province. Rates subject to change without notice. *O.A.C. E.& O.E.” Check with your Dominion Lending Centres Mortgage Professional for full details and to determine what rate will be available for you.

Tuesday, September 24, 2013

Canadian Retail Sales

Canadian retail sales rose 0.6 per cent in July on a monthly basis and were 3 per cent higher year-over-year. Retail sale were led by higher sales at gas stations, which grew 3.2 per cent, the largest increase among the 11 retail sub-sectors. Given today's data release, third quarter GDP growth is likely tracking in a range close to 2 per cent.

Retail sales in BC posted dipped 0.1 per cent from June to July but were 2.1 per cent higher year-over-year. Following an anemic sub-2 per cent growth in 2012, BC retail sales have grown just 0.6 per cent year-to-date in 2013.

Copyright BCREA -reprinted with permission

Monday, September 23, 2013

Teck plan includes Nelson area

A remediation plan by Teck Trail operation will extend as far north as Grohman Narrows even though there is no sign of smelter-related contamination in the area.

It’s part of the company’s response to an assessment that found vegetation risks can’t be ruled out on 7,900 hectares of the lower Columbia valley.

“It’s not that those 7,900 hectares are contaminated,” Nelson-based ecological consultant Marlene Machmer said. “It’s that based on looking at the vegetation one cannot say there were no effects from the smelter emissions.”

The potentially affected lands stretch from Genelle south to the US border and represent 18.5 per cent of the total area of interest, which extends as far north as Castlegar.

Under BC contaminated site regulations, Teck has to come up with a remediation plan for that area. But Machmer says the company wants to develop a more comprehensive plan that almost reaches Nelson.

“Teck’s rationale for looking at the larger area is that there are a number of opportunities within the broader landscape for restoration, enhancement, and conservation,” she said. “The expanded area is not necessarily being looked at for remediation, but for opportunities.”

The wider area allows the company more flexibility to offset impacts in certain locations by restoring others. However, Teck is still discussing with the Ministry of Environment what a potential offset is worth.

“If we develop a two-acre wetland in a location which is prime habitat, what would an offset be based on the value of that wetland? We don’t know yet,” company biologist Dave DeRosa said.

He cited the example of a new mine whose footprint is offset with enhanced or protected lands elsewhere. “That’s what this program is about. We want to bring what was potentially impacted back to a state where we’ve caused no net loss in the valley.”

Specific projects haven’t been named but may include improving soil conditions and habitat preservation.

DeRosa said no Teck contaminants are known to exist at Grohman Narrows or in the Nelson area, but the company has land holdings along the Kootenay River which might prove useful to the overall plan. Other private landowners will also likely be involved.

Machmer and DeRosa appeared before the Regional District of Central Kootenay board Thursday.

Saturday, September 21, 2013

Canadian Consumer Price Inflation

Canadian inflation registered 1.1 per cent in the twelve months to August, a slight deceleration from July's rate of 1.3 per cent. Core inflation, which strips out the most volatile components of the CPI, such as food and energy prices, increased 1.3 per cent in August. Consumer prices in BC actually fell 0.1 per cent in the 12 months to August largely as a result of the elimination of the HST.

Given that inflation continues to run well below the Bank of Canada's 2 per cent target, we expect very little urgency from the Bank of Canada in raising interest rates. Our expectation remains that the Bank will begin withdrawing monetary stimulus in late 2014 or early 2015.

Copyright BCREA - reprinted with permission

Wednesday, September 18, 2013

US Housing Starts

US housing starts rose close to 1 per cent in August to a seasonally adjusted annual rate (SAAR) of 891,000 units. Housing starts had reached a multi-year high of 1.02 million (SAAR) in March but have slowed to a less than 900,000 SAAR pace since then. Slower construction activity is likely a result of rising US mortgage rates and a slowdown in job-growth in recent months.

Although US new home construction has slowed of late, it is still well above the historical lows seen since the 2008 financial crisis. This has translated to a significant boost to the BC economy, as exports of BC wood products (representing about a fifth of all BC exports) have risen 30 per cent this year.

copyright BCREA - reprinted with permission

Tuesday, September 17, 2013

CREA Updates Resale Housing Forecast

CREA’s previous two forecasts anticipated that national

sales activity in 2013 would improve following the slow start to the year,

buoyed by the continuation of low interest rates amid a constructive economic

backdrop and the return of buyers who deferred purchase decisions or were

otherwise sidelined in the wake of tighter mortgage rules and lending

guidelines implemented last year.

National sales have improved more quickly than

anticipated. This likely reflects the transient influence of buyers with

pre-approved financing making purchases before their lower pre-approved rates

expire, particularly in some of Canada’s most active and expensive housing

markets.

“Real estate markets can be very different depending on

the region and community due to local factors,” said Laura Leyser, CREA

President. “For that reason, buyers and sellers should talk to their REALTOR®

about the housing market outlook where they live or might like to.”

CREA’s forecast for national sales activity has been

rebalanced with a modest upward revision this year to reflect stronger than

expected sales for the year-to-date. CREA’s previous forecast for national

sales in 2014 remains little changed.

Sales are forecast to reach 449,900 units in 2013. This

represents a decline of one per cent from last year and marks the sixth

consecutive year for which activity will have held to within short reach of

450,000 units.

The upward revision to activity in British Columbia

accounts for nearly half of the small upward revision to national activity this

year. The forecast for sales across the Prairies has also been raised. British

Columbia and Alberta are the only provinces where CREA annual sales are

forecast to rise above levels last year.

In 2014, national activity is forecast to reach to

465,600 units, a rebound of 3.5 per cent, and in line with its 10-year-average.

The forecast increase reflects a gradual strengthening of sales activity

alongside further economic, job, and income growth combined with only slightly

higher mortgage interest rates.

British Columbia is still forecast to post the strongest

sales increase in 2014 (+6.7%) compared to a weak result in 2013. Most other

provinces are forecast to post gains in the range between two and four per

cent.

Average prices have also remained firmer than expected

due to a rise in the share of national sales among larger and pricier markets

compared to last year.

The national average home price is projected to rise by

3.6 per cent to $376,300 in 2013, with gains strongest and in the range between

four and five per cent in Prairie provinces and around six per cent in

Newfoundland and Labrador. Average price growth in British Columbia and Ontario

is expected to come in just under the national increase, advance by less than

one per cent in Quebec and New Brunswick, and recede by less than one per cent

in Nova Scotia.

“The environment for home prices in Quebec, New Brunswick,

and Nova Scotia will likely be shaped by ample inventory levels relative to

sales,” said Gregory Klump, CREA’s Chief Economist. “The balance between the

two indicates that buyers have an abundance of listings from which to choose in

those provinces, which could keep pricing prospects in check until sales draw

down inventories.”

The national average price is forecast to edge up a

further 1.7 per cent in 2014 to $382,800. Alberta is forecast to see the

biggest average price increase in 2014 (3.4 per cent), with gains in

Saskatchewan, Manitoba, and Newfoundland and Labrador running just ahead of

overall consumer price inflation. Average prices in Quebec and New Brunswick

are expected to remain stable in 2014, with other provinces eking out gains

ranging from 0.5 to 1.5 per cent.

Copyright CREA – reprinted with permission

Canadian home sales up in August

According

to statistics released today by The Canadian Real Estate Association (CREA),

national home sales posted a month-over-month increase in August 2013.

Highlights:

·

National home

sales rose 2.8% from July to August.

·

Actual (not

seasonally adjusted) activity came in 11.1% above levels in August 2012.

·

The number of

newly listed homes was up 1.8% from July to August.

·

The Canadian

housing market has tightened but remains in balanced territory.

·

The national

average sale price rose 8.1% on a year-over-year basis in August.

·

The MLS® Home

Price Index (HPI) rose 2.9% year-over-year in August.

The number of home sales

processed through the MLS® Systems of Canadian real estate Boards and

Associations and other co-operative listing systems rose 2.8 per cent on a

month-over-month basis in August 2013. The number of local markets where sales

improved on a month-over-month basis ran roughly even with those where activity

edged lower in August, with increases in major urban centres tipping the

balance.

“All real estate is truly

local, but sometimes sales trends can change similarly in a large number of

markets at the same time due to factors that can affect all markets across

Canada,” said CREA President Laura Leyser. “The recent hike in fixed mortgage

rates is one example of an influence that affects all markets, but it’s just

one of many things that shape housing market trends. Your local REALTOR®

remains the best resource for understanding what’s driving the housing market

where you live or might like to.”

Actual (not seasonally

adjusted) activity came in 11.1 per cent ahead of levels reported in August

2012 to run roughly in line with its 10-year average. Sales were up on a

year-over-year basis in about two-thirds of local markets, led by double-digit

gains in Vancouver Island, Victoria, Greater Vancouver, the Fraser Valley,

Calgary, Edmonton and Greater Toronto.

“Sales activity dropped

sharply around this time last year in the wake of tightened mortgage rules and

has improved since then, so a sizeable year-over-year increase this August was

expected,” said Gregory Klump, CREA’s Chief Economist. “Buyers who put off

purchase decisions or who were otherwise sidelined by tighter mortgage rules

and lending guidelines implemented last year were anticipated to return to the

housing market. That said, the upward trend and levels for activity in recent

months has been steeper than expected, but that may not last.”

“Recent increases to fixed

mortgage rates caused sales to be pulled forward as buyers with pre-approved

financing at lower rates jumped into the market sooner than they might have

otherwise,” Klump added. “That pool of homebuyers has largely evaporated so demand

may soften over the fourth quarter. The outsized year-over-year gains may

persist, however, due to weak sales toward the end of last year.”

Some 325,180 homes have

traded hands across the country so far this year. That stands 2.9 per cent

below levels recorded in the first eight months of 2012. Notwithstanding the

recent upward trend in demand, CREA still expects the 2013 annual sales figure

to come in below the 2012 figure.

The number of newly listed

homes rose 1.8 per cent on a month-over-month basis in August. Slightly more

than half of all local markets recorded gains. As with sales activity, that

list includes many of Canada’s most active housing markets.

With sales activity having

risen by slightly more than new listings in August, the national sales-to-new

listings ratio edged up to 54.6 per cent compared to 54.1 per cent in July.

While the national housing market has firmed slightly in recent months, it

remains firmly rooted in balanced market territory where it has been since

early 2010.

Based on a sales-to-new

listings ratio of between 40 to 60 per cent, a record 73 per cent of all local

markets were in balanced market territory in August.

The number of months of

inventory is another important measure of balance between housing supply and

demand. It represents the number of months it would take to completely

liquidate current inventories at the current rate of sales activity. There were

5.9 months of inventory at the national level at the end of August, down from

6.1 months one month earlier. As with the sales-to-new listings ratio, the

current months of inventory measure marks a slightly firmer but still well

balanced market.

The actual (not seasonally

adjusted) national average price for homes sold in August 2013 was $378,369, an

increase of 8.1 per cent from the same month last year. Year-over-year average

price gains in recent months reflect outsized sales declines last year among

some of Canada’s larger and more expensive markets as a proportion of national

activity. For example, Greater Vancouver’s long-term (10 year) average

proportion of national activity is 7.4 per cent on an unadjusted basis but it

had fallen to 4.6 per cent in August 2012. Since then, it has rebounded and now

stands at 6.3 per cent - its second-highest level in the past year.

If Greater Toronto and

Greater Vancouver are removed from the national average price calculation, the

year-over-year increase is cut from 8.1 per cent to 4.8 per cent. A better

gauge of what’s going on with prices is the MLS® Home Price Index (MLS® HPI),

which is not affected by changes in the mix of sales the way that average price

is.

The Aggregate Composite

MLS® HPI rose 2.92 per cent compared to August 2012, up from 2.66 per cent in

July. That said, year-over-year growth in the price index has slowed since late

2011 and has ranged between two and three per cent for the past seven months.

Year-over-year price

growth picked up among all property types tracked by the index. One-storey and

two-storey single family homes saw year-over-year price gains of 3.45 per cent

and 3.61 per cent respectively in August. Year-over-year price growth for

townhouse/row and apartment units remains more modest, with these segments

recording gains of 1.85 per cent and 1.25 per cent respectively in August.

Year-over-year price

growth in the MLS® HPI was mixed across the markets tracked by the index.

Copyright CREA - reprinted with permission

BCREA Housing Market Update (September 2013)

Copyright BCREA

Canadian Manufacturing Sales

Canadian

manufacturing sales rebounded strongly from a decline in June, posting an

increase of 1.7 per cent in July. Stronger sales were recorded across the

manufacturing sector as 15 of 21 manufacturing subsectors increased.

In BC, manufacturing sales rose 1 per cent from June but were 1.1 per cent lower than July 2012. Sales of BC wood products rebounded in July following a sharp decline in June, rising 3.1 per cent month-over -month and 13 per cent compared to July 2012. Overall manufacturing sales continue to be pulled lower by weak demand for non-durable goods such as food, textiles and in particular BC pulp and paper. Sales of non-durable goods are down 6 per cent year-to-date while total manufacturing sales are up 1.3 per cent.

In BC, manufacturing sales rose 1 per cent from June but were 1.1 per cent lower than July 2012. Sales of BC wood products rebounded in July following a sharp decline in June, rising 3.1 per cent month-over -month and 13 per cent compared to July 2012. Overall manufacturing sales continue to be pulled lower by weak demand for non-durable goods such as food, textiles and in particular BC pulp and paper. Sales of non-durable goods are down 6 per cent year-to-date while total manufacturing sales are up 1.3 per cent.

Copyright BCREA –

reprinted with permission

Dominion Lending Centres Weekly Rate Minder

|

rates are subject to change without notice

Prime

Rate is 3.00%

|

|

Variable

rate mortgages from as low as Prime minus .40%

|

Monday, September 16, 2013

Housing Market Turnaround Continues Unabated

The British Columbia Real Estate Association (BCREA) reports that a total of 6,863 residential sales were recorded by the Multiple Listing Service® (MLS®) in BC during August, up 28.6 per cent from August 2012. Total sales dollar volume was 39.7 per cent higher than a year ago at $3.66 billion. The average MLS® residential price in the province was $533,400, up 8.6 per cent from August 2012.

"After sitting on the sidelines for much of 2012, home buyers were out in force during the summer months,” said Cameron Muir, BCREA Chief Economist. “Fear of a housing market hard landing has given way to a sense of urgency to lock-in a mortgage at a low interest rate."

While higher mortgage interest rates are on the horizon, BCREA forecasts the five-year posted mortgage rate to be 50 basis points higher a year from now. The impact on consumer demand is expected to be largely offset by stronger economic conditions and the associated employment growth.

Year-to-date, BC residential sales dollar volume was up 1.5 per cent to $26.5 billion, compared to the same period last year. Residential unit sales were down 0.6 per cent to 49,849 units, while the average MLS® residential price was up 2 per cent at $532,130.

Copyright BCREA – reprinted with permission

Thursday, September 12, 2013

Canadian Housing Starts

Canadian housing starts registered 180,291 units at a seasonally

adjusted annual rate (SAAR) in August, down from 193,021 in July. The trend in Canadian new home

construction remained relatively unchanged at

187,000 units SAAR over the past six months, a rate that is roughly in-line

with Canadian household formations. On a year-over-year basis, housing

starts were down 20 per cent.

New home construction in BC urban centres fell 19 per cent from July to 24,990 SAAR . On a year-over-year basis, total starts were 10 per cent lower than August 2012. Single-detached starts were 14 per cent higher over last year, while multiples declined 19 per cent.

Looking at census metropolitan areas (CMA) in BC, total starts in the Vancouver CMA were 14 per cent lower year-over-year at 1,530 units. Single family starts rose 16 per cent while multiples tumbled 21 per cent. In the Victoria CMA, total starts were down 5 per cent compared to last year as a 42 per cent jump in single family starts was offset by a 13 per cent decline in multiples. New home construction in the Kelowna CMA fell 20 per cent year-over-year. The decline was broad-based with both single family and multiples lower. In the Abbotsford-MIssion CMA, starts were off 21 per cent compared to August 2012 due to a sharp drop off in multiples starts.

New home construction in BC urban centres fell 19 per cent from July to 24,990 SAAR . On a year-over-year basis, total starts were 10 per cent lower than August 2012. Single-detached starts were 14 per cent higher over last year, while multiples declined 19 per cent.

Looking at census metropolitan areas (CMA) in BC, total starts in the Vancouver CMA were 14 per cent lower year-over-year at 1,530 units. Single family starts rose 16 per cent while multiples tumbled 21 per cent. In the Victoria CMA, total starts were down 5 per cent compared to last year as a 42 per cent jump in single family starts was offset by a 13 per cent decline in multiples. New home construction in the Kelowna CMA fell 20 per cent year-over-year. The decline was broad-based with both single family and multiples lower. In the Abbotsford-MIssion CMA, starts were off 21 per cent compared to August 2012 due to a sharp drop off in multiples starts.

Canada housing prices bounce higher but no crash seen

By Louise Egan

Canadian

housing prices climbed to a record high in August, according to a price index

released on Thursday that suggested the property market, long the country's

biggest engine of economic growth, remains strong but not frothy.

Home prices rose in August from

what was already a record high in July, but the annual price increase remained

subdued, the Teranet-National Bank Composite House Price Index showed.

The index, which measures

price changes for repeat sales of single-family homes, showed prices rose 0.6

percent in August from a month earlier, below the seasonal norm.

Prices rose just 2.3 percent

from a year earlier, a slight acceleration from July. The annualized gains for

the last five months have been the smallest since November 2009, and well below

the U.S. equivalent, which was up 12 percent in June.

"The demographics and the

low interest rates at the moment are supportive of the market," said Marc

Pinsonneault, senior economist at National Bank Financial.

Toronto and Calgary, Canada's

oil capital, led the way for price hikes. But prices dropped in five of the 11

markets surveyed across the country, which Pinsonneault said was hardly

evidence of overheating.

"We don't see the market

having a collapse similar to the one they had in the U.S.," he said.

The housing market has been a

focal point for Canadian policymakers since a boom that followed the 2008-09

recession. A prolonged period of low borrowing costs and rising house prices

led to record-high household debt and rising fears of a property bubble that

could pop and give way to a financial disruption.

In response, the government

tightened mortgage lending rules four times, and after the latest intervention,

in July 2012, the property market cooled markedly. The market bounced back this

spring and has since appeared to stabilize.

But housing is still seen as

overvalued in some areas, spurring the question of whether any downturn will be

sudden or gradual. Most economists at Canada's major banks see the market

staying stable in the medium term.

Separately, Statistics Canada

said on Thursday its new housing price index climbed 0.2 percent in July from

June, beating market expectations of a 0.1 percent gain and bringing the

year-on-year increase to 1.9 percent.

Calgary saw the biggest

12-month jump in new home prices, 5.8 percent, since December 2007. In

Toronto-Oshawa, prices rose 0.3 percent on the month and 2.6 percent on the

year.

Prices rose in 10 cities, fell

in six and were unchanged in five.

The new housing price index

excludes condominiums, which the government has said are a particular cause for

concern because of overbuilding, especially in Toronto.

The aggressive rebound in home

prices has been accompanied by a recovery in existing home sales.

All told, the impact of

Ottawa's crackdown on mortgages rules has faded, said Mazen Issa, economist at

TD Securities.

Still, mortgage rates have

begun to rise, likely dampening home purchases.

"We do not see a strong

case for rampant home price appreciation over the medium-term as the backup in

mortgage rates will erode affordability," Issa said.

"Moreover, sales activity

is likely to slow as household balance sheets are stretched and the increase in

home prices may have priced-out potential home buyers," he said.

Monday, September 9, 2013

Canadian Building Permits

Canadian

building permits jumped 20.7 per cent in July to $8 billion, the sixth gain in

the past seven months. Higher building permits were driven primarily by

stronger construction intentions in Ontario, Alberta and Quebec.

BC building permits fell 8.2 per cent in July from June as residential building permits declined 9.3 per cent and non-residential permits dropped 6.2 per cent. Year-over-year, construction intentions in July were 23 per cent lower than in 2012. On the residential side, the total number of units permitted fell from 2,858 in June to a still relatively strong 2,310 units in July. Permits for single-family units actually rose significantly from 640 in June to 782 in July while permits for apartments declined from 1,614 to 1,086.

Permitting activity in BC's four major census metropolitan areas (CMA) varied significantly in July. In the Vancouver CMA, permits fell 25.7 per cent on a monthly basis and were 40 per cent lower year-over-year. Construction intentions in the Victoria CMA rose sharply for the second month in a row, rising 21.2 per cent on a monthly basis and 21.9 per cent year over year. in the Kelowna CMA, permits were up 65.1 per cent from June and were 49.9 per cent higher than July 2012. Finally, in the Abbotsford-Mission CMA, building permits declined 12.7 per cent month-over-month and 19 per cent year-over-year.

Copyright BCREA -reprinted with permission

BC building permits fell 8.2 per cent in July from June as residential building permits declined 9.3 per cent and non-residential permits dropped 6.2 per cent. Year-over-year, construction intentions in July were 23 per cent lower than in 2012. On the residential side, the total number of units permitted fell from 2,858 in June to a still relatively strong 2,310 units in July. Permits for single-family units actually rose significantly from 640 in June to 782 in July while permits for apartments declined from 1,614 to 1,086.

Permitting activity in BC's four major census metropolitan areas (CMA) varied significantly in July. In the Vancouver CMA, permits fell 25.7 per cent on a monthly basis and were 40 per cent lower year-over-year. Construction intentions in the Victoria CMA rose sharply for the second month in a row, rising 21.2 per cent on a monthly basis and 21.9 per cent year over year. in the Kelowna CMA, permits were up 65.1 per cent from June and were 49.9 per cent higher than July 2012. Finally, in the Abbotsford-Mission CMA, building permits declined 12.7 per cent month-over-month and 19 per cent year-over-year.

Copyright BCREA -reprinted with permission

Friday, September 6, 2013

Canadian and US Employment

Canadian employment increased by 59,000 in August,

offsetting a loss of 39,000 jobs in July. The Canadian unemployment rate fell

0.1 points to 7.1 per cent. Over the past six months, employment gains have

averaged 12,000 per month and total employment has grown 1.4 per cent in the

past 12 months.

In BC, employment grew by 6,200 jobs, though that growth was entirely concentrated in part-time work. The provincial unemployment rate ticked lower by 0.1 points to 6.6 per cent. Year-to-date, employment growth in BC is flat while the level of total employment in August is 0.3 per cent lower than in 2012.

In the US, firms added 169,000 jobs to payrolls in August, while the unemployment rate fell to 7.3 per cent. However, payrolls were revised 100,000 lower for June and July, The quarterly pace of job growth so far in the third quarter is nearly 50,000 jobs slower than in the second quarter and 70,000 off the pace set in the first quarter. Given that slowdown, a tapering of Federal Reserve bond purchases may not proceed in the fall as previously expected. If so, that would relieve some of the current upward pressure on long-term interest rates and mortgage rates.

In BC, employment grew by 6,200 jobs, though that growth was entirely concentrated in part-time work. The provincial unemployment rate ticked lower by 0.1 points to 6.6 per cent. Year-to-date, employment growth in BC is flat while the level of total employment in August is 0.3 per cent lower than in 2012.

In the US, firms added 169,000 jobs to payrolls in August, while the unemployment rate fell to 7.3 per cent. However, payrolls were revised 100,000 lower for June and July, The quarterly pace of job growth so far in the third quarter is nearly 50,000 jobs slower than in the second quarter and 70,000 off the pace set in the first quarter. Given that slowdown, a tapering of Federal Reserve bond purchases may not proceed in the fall as previously expected. If so, that would relieve some of the current upward pressure on long-term interest rates and mortgage rates.

Copyright BCREA - reprinted with permission

Thursday, September 5, 2013

BC Commercial Leading Indicator Rises in Second Quarter

The BCREA Commercial

Leading Indicator (CLI) rose for the second consecutive quarter, increasing 1.2

points from the first quarter of 2013. The index is currently sitting at 113.4.

On a year-over-year basis, the CLI is 0.2 per cent above the second quarter of

2012. The index reached an all-time high of 116.1 in the second quarter of

2007.

An

increasing CLI in the first half of 2013 offset a sharp decline in the final

quarter of 2012 to produce an overall flattening in the index’s underlying

trend. This indicates that growth in the commercial real estate sector should

continue at an average pace through the remainder of 2013.

"The

second quarter saw a significant increase in the CLI as economic activity and

office employment rebounded,” said Brendon Ogmundson, BCREA Economist.

“However, rising long-term interest rates may present an obstacle to growth in

the second half of 2013."

Copyright BCREA –

Reprinted with permission

Your Home Value

Whether you’re purchasing

a home or looking to refinance, determining a property’s value is an essential

step in the mortgage application process. You can help by providing precise and

accurate information about your property.

The

value of a property is determined by a number of different criteria, each of

which can influence how much your home is currently worth. These criteria range

from the square footage and the age of your home, to its location, construction

quality, architectural features and even the number of bathrooms.

Property

valuation and mortgages

When applying for a mortgage, you’ll be asked a series of questions about your property. This information will help establish the property value – a critical element for determining the amount of your mortgage loan.

If

you’re buying a home, your mortgage application will include the purchase price

along with a detailed description of the property. For refinancing, the lending

value will be established after considering recent sales in your area, the

latest municipal value assessment and any significant improvements you’ve made

to the property.

If you want to add the

cost of any planned improvements to your mortgage application, be sure to

provide all of your plans and cost estimates.

Professional

appraisal

A professional appraisal may be required if a more in-depth assessment of the value of your property is needed.

This

process includes a professional assessment of the property’s physical and

functional characteristics, a detailed comparison of the home to recent

comparable sales in nearby areas and an assessment of current market conditions

affecting the property. It’s important to allow the appraiser access to the

property in a timely manner, in order to minimize the time required to obtain

financing.

Energy Retrofits

Energy

efficiency retrofits can reduce your energy consumption, impact on the

environment and save you money. If not done properly, however, replacing

windows, adding insulation and reducing air leaks can have unintended effects

on your house, indoor air quality and your family’s safety.

So before the

work is started, have your house checked for pre-existing conditions that could

lead to problems down the road. These problems may include high humidity, water

leaks, dampness and mold. Your house may also have stale air, lingering odours,

soil gas intrusion and pollutant emissions from household products. Structural

sags, cracks and deflections in the walls, floors or ceilings also represent

problems that may need to be addressed first. Undertaking an energy efficiency

building envelope retrofit before dealing with pre-existing conditions may make

the problems worse and result in loss of time and money invested in the

retrofit work.

For example,

sealing air leaks can improve comfort, reduce heating costs and protect walls,

windows and attic because it cuts down on the amount of leaking in to and out

of your house. But, this can cause the air in the house to seem stale and

odours to linger longer. Odours from previously unnoticed sources such as

hobbies, pets or stored items may become more noticeable.

Measuring the

air leakage of the house with a blower door test before and after the retrofit

work can offer an idea of how much the air leakage of the house has been

reduced. If the reduction is significant, it may be a good idea to add a

bathroom fan, range hood, air exchanger or, better yet, a heat recovery

ventilator. When properly designed and installed, mechanical ventilation is

more energy efficient and effective than uncontrolled air leakage.

Reducing air leaks can also decrease the air needed for

the safe and efficient operation of furnaces, water heaters and fireplaces.

Adding powerful or numerous exhaust fans can further increase the risk that

fuel-fired appliances will not properly vent combustion gases – a situation

known as “backdrafting”.

Providing adequate combustion

air for heating appliances and sufficient make-up air to balance exhaust fans

may be a necessary part of a building envelope insulation retrofit project. The

safest solution is to convert fuel-fired appliances to direct-vent units or

sealed-combustion units. The backdrafting risk can often be assessed by a

qualified energy advisor. Mechanical contractors can be consulted regarding

make-up air systems as well as direct-vent and sealed-combustion appliance

options for furnaces, hot water tanks and fireplaces.

Retrofitting your home to make

it more energy efficient and to reduce your heating and cooling costs is always

a good idea. By recognizing and addressing the potential issues associated with

any retrofit project, you’ll help reduce the likelihood of problems occurring

after the work is done. Consult a qualified energy advisor, building

professional, home inspector or contractor before you begin your energy

efficiency retrofit to better understand, and plan for, pre-existing conditions

and possible unintended effects of the retrofit project. Often, corrective

measures can be planned that not only prevent problems, but also add value to

the overall project.

To learn more about other sustainable technologies and

practices that can improve the performance of your home, visit Canada Mortgage

and Housing Corporation’s website at www.cmhc.ca or call 1-800-668-2642.

Mortgage Rates

|

|||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||

Wednesday, September 4, 2013

Bank of Canada Interest Rate Decision

The Bank of Canada announced this morning that

it is maintaining its target for the overnight rate at 1 per cent. In its

accompanying statement, the Bank highlighted that an uncertain global economy

is delaying an expected rotation of growth in Canada toward exports and

investment. This means that the burden of economic growth will remain on

households at a time when most households are deleveraging and looking to slow

consumption. All of this adds up to a Canadian economy that will grow below

trend in 2013, likely at a rate of around 1.5 per cent. Below

trend growth will translate to continued subdued inflation, which the Bank

anticipates will return slowly to its 2 per cent target in 2014. As for the

Bank's tightening bias, language around the withdrawal of monetary stimulus has

been significantly moderated. The Bank anticipates a gradual normalization of

policy interest rates as conditions for inflation, growth and household debt

normalize.

Rising long-term Canadian interest rates, along with somewhat soft economic growth through the first half of 2013, have taken some urgency out of future monetary policy tightening. In particular, higher long-term rates will further slow growth in household debt via higher mortgage and other key lending rates which will allow the Bank to push increases in its overnight out to late 2014 or early 2015.

Rising long-term Canadian interest rates, along with somewhat soft economic growth through the first half of 2013, have taken some urgency out of future monetary policy tightening. In particular, higher long-term rates will further slow growth in household debt via higher mortgage and other key lending rates which will allow the Bank to push increases in its overnight out to late 2014 or early 2015.

Copyright BCREA reprinted with permission

Subscribe to:

Posts (Atom)