Nelson BC real estate blog by Robert Goertz of Valhalla Path Realty. Keeping you up to date with the Nelson and West Kootenay real estate markets.

Tuesday, December 9, 2008

Housing Starts Moderate in November

“The decrease in November housing starts can be attributed in part to the volatile multiple starts segment,” said Bob Dugan, Chief Economist at CMHC’s Market Analysis Centre. “Still, housing starts in November remain consistent with our forecast which calls for more moderate activity of 212,000 units this year and 178,000 units next year. Note that at the beginning of the new millennium, Canada posted strong housing start levels given a pent-up demand that existed then. Over the last few years, this excess demand gradually decreased and our forecast for 2008 and 2009 reflects this new reality with housing starts, more aligned with long run demographic demand.”

The seasonally adjusted annual rate of urban starts decreased 21.6 per cent to 144,800 units in November. Urban multiple starts moderated 29.1 per cent to 81,700 units, while urban single starts eased 9.0 per cent to 63,100 units in November.

November’s seasonally adjusted annual rate of urban starts moderated in all regions of Canada. Urban starts declined to 17,900 units in British Columbia, 23,500 units in the Prairies, 54,700 units in Ontario, 41,100 units in Quebec, and 7,600 units in the Atlantic region.

Rural starts were estimated at a seasonally adjusted annual rate of 27,200 units in November.

For the first 11 months of 2008, actual starts in rural and urban areas combined moderated by an estimated 7.6 per cent, compared to the same period last year. Year-to-date actual starts in urban areas have decreased by an estimated 3.9 per cent over the same period in 2007. Actual urban single starts for the January to November period of this year were 18.4 per cent lower than they were a year earlier while urban multiple starts were up by 8.6 per cent over the same period.

CMHC December 8, 2008

Friday, November 28, 2008

Financial/Equity Markets Impact October Home Sales

“Housing demand was negatively affected by the global financial crisis and a sharp downturn in the equity markets,” said Cameron Muir, BCREA Chief Economist. “These events exacerbated an already low level of consumer confidence, keeping many potential homebuyers on the sidelines.”

Residential sales in October were the lowest since December 2000, on a seasonally adjusted basis. “Home sales are unlikely to fall much further,” added Muir. “While the provincial economy has weakened, the fundamentals support a higher level of home sales than experienced last month.”

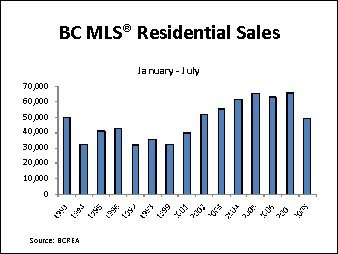

Year-to-date MLS® residential sales dollar volume in the province declined 27 per cent to $29.2 billion compared to the same period last year. Provincial MLS® sales declined 30 per cent to 63,760 units, while the average residential price increased 5 per cent to $458,078 over the same period.

“Copyright British Columbia Real Estate Association. Reprinted with permission.”

Sunday, November 16, 2008

October 2008 Kootenay Real Estate Stats

During the same period the number of listings increased by 57.7%. This has resulted in a decrease in the number of sales to the number of listings. Represented as the sales to listing ratio we have had a drop from 16.2% in 2007 to 7.2% in 2008.

There are some excellent opportunities to purchase right now. If you have been thinking about investing in Real Estate but reluctant to jump in now may be the right time.

Financial/Equity Markets Impact October Home Sales

“Housing demand was negatively affected by the global financial crisis and a sharp downturn in the equity markets,” said Cameron Muir, BCREA Chief Economist. “These events exacerbated an already low level of consumer confidence, keeping many potential homebuyers on the sidelines.”

Residential sales in October were the lowest since December 2000, on a seasonally adjusted basis. “Home sales are unlikely to fall much further,” added Muir. “While the provincial economy has weakened, the fundamentals support a higher level of home sales than experienced last month.”

Year-to-date MLS® residential sales dollar volume in the province declined 27 per cent to $29.2 billion compared to the same period last year. Provincial MLS® sales declined 30 per cent to 63,760 units, while the average residential price increased 5 per cent to $458,078 over the same

period.

“Copyright British Columbia Real Estate Association. Reprinted with permission.” Vancouver November 14, 2008

Wednesday, November 12, 2008

Government of Canada Announces Additional Support for Canadian Credit Markets

This action will increase to $75 billion the maximum value of securities purchased through Canada Mortgage and Housing Corporation (CMHC) under this program.

"At a time of considerable uncertainty in global financial markets, this action will provide Canada’s financial institutions with significant and stable access to longer-term funding," said Minister Flaherty.

"This extension of the program to purchase insured mortgages will further support the availability of credit, which will benefit Canadian households, businesses and the economy. In addition, it will earn a modest rate of return for the Government with no additional risk to the taxpayer."

In addition:

The Government will reduce the base commercial pricing of the Canadian Lenders Assurance Facility by 25 basis points. It will also waive the 25 basis point across-the-board surcharge for insurance provided under the Facility until further notice. This will make the Facility more competitive with similar programs offered in other countries. The term sheet for the Facility will be posted on the Finance Canada web site (www.fin.gc.ca) shortly.

The Office of the Superintendent of Financial Institutions (OSFI) announced yesterday an increase in the allowable limit of innovative and preferred shares in Tier 1 capital. This will provide Canadian financial institutions with more sources of funds to support lending in Canada. This will also ensure that similar decisions in other countries do not place Canadian institutions at a competitive disadvantage. Further technical information is available from OSFI at www.osfi-bsif.gc.ca.

As the Bank of Canada noted in its announcement on October 13, the Bank will continue to provide exceptional liquidity to the Canadian financial system as long as conditions warrant.

"The Government of Canada is prepared to take whatever steps are necessary to ensure that Canada’s strong financial system is not put at a competitive disadvantage by developments in other countries. The Government will not allow Canada’s financial system, which has been ranked as the soundest in the world, to be put at risk by global events," said Minister Flaherty.

CMHC November 12, 2008

Tuesday, November 11, 2008

Housing Starts Remained Strong in October

“Housing starts remained strong in October and are consistent with our new home construction forecast for 2008,” said Bob Dugan, Chief Economist at CMHC’s Market Analysis Centre. “The slight decrease in housing starts is the result of declines in both single-detached and multiple starts in October.”

The seasonally adjusted annual rate of urban starts eased 4.2 per cent in October, compared to September. Urban multiples declined in October by 6.0 per cent to 115,300 units. Urban single starts decreased 1.1 per cent to 69,300 units in October compared to September.

October’s seasonally adjusted annual rate of urban starts moderated in three out of the five regions of Canada. Urban starts increased to 41,300 units in the Quebec region and to 9,600 units in Atlantic Canada. On the other hand, urban starts declined to 27,900 units in British Columbia, 26,900 units in the Prairies, and 78,900 units in Ontario. Single urban starts decreased in all regions in October, with the exception of Ontario, where they increased by 10.1 per cent.

Rural starts were estimated at a seasonally adjusted annual rate of 27,200 units in October.

For the first ten months of 2008, actual starts in rural and urban areas combined were down an estimated 1.6 per cent, compared to the same period last year. Year-to-date actual starts in urban areas have decreased by an estimated 1.3 per cent over the same period in 2007. Actual urban single starts for the January to October period of this year were 16.3 per cent lower than they were a year earlier while urban multiple starts were up by 11.6 per cent over the same period.

CMHC Ottawa November 10, 2008

Sunday, November 2, 2008

Slow Market Sales Tactics

So far in 2008, in an area which includes Nelson, Nelson rural, Kaslo and Salmo, there have been 240 expired listings compared with a total of 171 expired listings for all of 2007. Over the past 7 days alone there have been 64 listings expire.

Some of these expired contracts will be re-listed however some Sellers will decide to take their property off of the market permanently. Seller fatigue being the term used to describe how Sellers are feeling after being unsuccessful in selling their homes. Being a Seller myself I understand the emotional roller coaster that causes this fatigue.

No matter what the market conditions the best that you can hope to do as a Seller is sell for fair market value. To do this requires constantly reevaluating market conditions and revisiting price. The current economic uncertainty has certainly slowed the activity in the real estate market however properties do continue to sell.

Properties that are selling have successful achieved the following two things:

- Priced it Right - For a property to sell right now it must be the most well priced home on the market. There can be no question as to the value. In short when it is viewed by prospective Buyers it should appear to be a deal.

- Be Prepared - Have all of the maintenance issues looked after, hire a home stager, have information regarding utilities available and be mentally prepared to negotiate.

Saturday, November 1, 2008

Housing Starts tp Moderate in 2009

“High employment levels, rising incomes and low mortgage rates have continued to provide a solid foundation for healthy housing markets this year,” said Bob Dugan, Chief Economist for CMHC. “Housing starts will moderate to 212,200 units in 2008 and 177,975 units in 2009.”

Existing home sales, as measured by the Multiple Listing Service (MLS®)1, which reached a record level of 523,701 sales in 2007, will moderate in 2008 to 452,225 units. In 2009, MLS® sales will move to 433,375 units. Despite a moderation in MLS® sales, demand for existing homes will remain strong by historical standards. With housing markets having become balanced across Canada, the rate of growth in the average MLS® price will moderate. Average prices will reach $306,500 in 2008 and $306,700 in 2009.

October 30, 2008 CMHC

Thursday, October 30, 2008

Consumer Confidence Key to Housing Market Conditions

Vancouver, BC – October 29, 2008. The British Columbia Real Estate Association (BCREA) released its fall 2008 Housing Forecast today.

BC Multiple Listing Service® (MLS®) residential sales are forecast to decline 28 per cent from 102,805 units in 2007 to 73,700 units this year. A modest 4 per cent increase to 76,500 units is forecast for 2009.

“The erosion of consumer confidence that began with rising fuel prices earlier in the year is continuing, as the global financial crisis and volatile equity markets have BC households concerned about their own finances,” said Cameron Muir, Chief Economist.

A weaker provincial economy is expected to increase the jobless rate from 4.4 per cent this year to 4.9 per cent in 2009. “While some job losses will occur next year, BC households will remain on a relatively solid financial footing,” added Muir.

The average MLS® residential price is forecast to increase 3 per cent to $453,000 this year. However, home prices peaked in the first quarter and have been edging lower for several months. For 2009, the average price is forecast to decline 9 per cent to $413,000, with most of the decrease having already occurred by the end this year.

Downward pressure on home prices is expected to ease by the second quarter of 2009, as an increase in affordability and consumer confidence induces a modest growth in sales. The inventory of homes for sale is also expected to decline in the coming months as potential home sellers delay putting their homes on the market until conditions improve.

“Copyright British Columbia Real Estate Association. Reprinted with permission.”

Simple tips for using less hot and cold water

- Wash clothes with cold water. Between 80 and 90 per cent of the energy used to wash clothes is for heating the water. If all families switched to cold water washing, British Columbians would save $87 million.

- Install low-flow showerheads. They can use 40 per cent less hot water than older models and can be installed in minutes.

- Use faucet aerators. They mix air bubbles in the flow of water, slowing the amount of water that flows out, and save up to 40 per cent of the water used for hand washing.

- Keep a jug of water in the fridge rather than running the tap for cold water.

To learn more about ways to conserve energy in everyday life, as well as BC Hydro’s Power Smart residential programs such as mail-in rebates, ENERGY STAR® windows, PST exemptions and Power Smart New Homes, visit www.bchydro.com/powersmart.

Saturday, October 25, 2008

Nelson Landing Unveiled

With the coals still smoldering across the city from the Kutanai Landing waterfront project debate, Sorensen Fine Homes principal David Sorensen appeared before city council Monday night touting the merits of his housing project, slated for the former Kootenay Forest Products land on the shores of Kootenay Lake.

The phrases “affordable housing,” “no cost to the taxpayer” and “site remediation” were again bandied about as Sorensen made his presentation to council.

He is proposing to build a 150-unit housing development with up to 30 below market value units, a hotel and small conference centre and 26 commercial units on the 12.5 acre parcel of land.

There would also be a marina included in the scope of the project, as well as public access to Red Sands Beach.

Like Kutanai Landing before it, the initial rhetoric sounds good, said Councilor Ian Mason, but proof of the project’s merit will be revealed as the development application process play’s out.

The affordable housing component, at first glance, is enticing, as is the $80 million worth of new construction and significant infusion of new tax base for the city, he said.

“Basically we’ve been presented with a concept but the devil is always in the details in these things. I’m cautiously optimistic with this one.” He said.

“It’s a big project for someone to build 20 to 30 units, it’s a big step. I’m happy to see people still have confidence in development in our community given the global financial climate.”

No lots will be sold in the development said Sorensen, only finished houses. For them to control the architecture and create something beautiful like the old streets of Nelson is really a big deal for the developer of fine-crafted homes.

“it’s absolutely all about a community,” he said. “There are no condominiums, we all get to use the waterfront, we all get to use the beach and nothing is over two-and-a-half storey buildings.”

Parts of the building site are considered brown-field and require environmental remediation. Sorensen has already acquired an approval in principle from the Ministry of Environment and will use Pottinger Gaherty as its environmental consultant.

Sorensen told council the approval has taken a risk assessment approach, with what is below the surface of the site being left untouched.

There will be a build up of clean top-soil around the new buildings with “many sources of clean fill” being available, said Sorensen.

The Peco decks, reaching out into the lake will be retained and used for a hotel inn, office and retail commercial space and a small conference centre. It will also be the hub for the marina.

Although Mason thought the project would fit nicely into the community – with affordable housing, public access to the waterfront, site remediation and no high-rise condominiums – he was cautiously optimistic.

“At first blush it looks like a project that would be widely accepted by the community. Having said that there is always someone who wants to toss a rock in that,” he said.

Rezoning will be sought, said Sorensen, because the zoning attached to the property is such a “mish mash” that the city wants to write it fresh, making it a public process to let people know what is happening there.

As the application process unfolds it will be seen whether council will be called on to make some decisions. The next step will be to formalize the application for the project and then go through the process for the permit approval.

Timothy Schafer Nelson Daily News October 23, 2008

Friday, October 17, 2008

U.S. new home construction tumbles in September

The U.S. Commerce Department reported that new construction fell by 6.3 per cent for the month — much worse than the drop of 1.6 per cent that had been projected by economists.

On a seasonally adjusted basis, total production came in at an annual rate of 817,000 — the lowest pace since January 1991, when the U.S. was in recession.

Economists surveyed by Thomson/IFR had been expecting last month's housing starts to come in at an annual rate of 880,000 units.

The drop was led by a 20.9 per cent plummet in housing starts in the northeastern part of the country. Construction of single-family homes there fell to their lowest level on record.

The U.S. housing sector has been battered by the fallout from the subprime mortgage mess. Rising foreclosures have flooded the market with unsold properties, sending prices down.

"This housing sector report was simply awful, as it suggests that the U.S. housing market correction may have quickened in recent months," said Millan Mulraine, economics strategist at TD Securities.

"And with the U.S. economy appearing to have softened considerably in recent months, and the labour market remaining in a very depressing state, there is little to suggest that a turnaround in activity will occur any time soon," Mulraine said.

Royal Bank economist Josh Heller said that if a silver lining is to be found, it lies in the fact that the lower starts fall, the faster excess inventory in the U.S. housing sector will be worked off.

"Only once inventories of unsold homes retreat back to historical norms do we expect prices to stabilize and a steady recovery to take hold," Heller said.

Friday, October 17, 2008 CBC News

Attainable Housing and Green Buildings: Budget 2009

“The Property Transfer Tax detracts from provincial affordable housing initiatives previous budgets have put in place, such as enhancements to the First-Time Home Buyers’ Program, and changes to the Home Owner Grant aimed at seniors,” said Robert Laing, BCREA Chief Executive Officer.

The BC Government levies a Property Transfer Tax rate that is 129 per cent higher than the average for Canadian provinces. The rate—1% on the first $200,000 of a property and 2% on the remainder—has remained the same since the tax was introduced in 1987. The negative impact of the Property Transfer Tax on British Columbians appears to be at odds with the provincial government’s competitive taxation principles.

In a submission to the Select Standing Committee on Finance and Government Services, and as a first step to a fairer Property Transfer Tax that enables greater affordability and accessibility to housing, BCREA and CHBA BC suggest the government restructure the Property Transfer Tax to reflect current housing market conditions in BC by increasing the 1% tax threshold to $400,000 and levying 2% tax on the balance.

The second key recommendation is for the government to improve the attainability of green housing through a program that provides a Property Transfer Tax rebate to buyers of new homes that meet a Built Green™ standard for greenhouse gas emissions and less waste. With the introduction of a new building code and a desire by CHBA BC builders to build to a higher energy standard, a home can now cost between 4 and 6% more.

“Built Green™ BC is about healthier buildings for homeowners and for the environment,” noted M.J. Whitemarsh, CEO of the Canadian Home Builders’ Association of BC. “The incentive we propose would return money to British Columbians in a way that’s directly targeted at reducing greenhouse gas emissions.”

With Budget 2009, the BC Government has the opportunity to build on past initiatives to help British Columbians become homeowners and reduce the province’s carbon footprint.

“Copyright British Columbia Real Estate Association. Reprinted with permission.”

Wednesday, October 15, 2008

Home Prices Down; Affordability Improves

“Weaker consumer demand and a large number of homes for sale are having an impact on home prices in the province,” said Cameron Muir, BCREA Chief Economist. “Despite relatively strong fundamentals, consumer confidence is low. The global liquidity crisis and volatile equity markets are intensifying this sentiment, causing many households to pull back spending on major purchases.”

“However, affordability is improving,” added Muir. “The carrying cost of the average home in the province is now lower than at any time since the end of 2006.”

Year-to-date MLS® residential sales dollar volume in the province declined 24 per cent to $27.5 billion compared to the same period last year. Provincial MLS® sales declined 28 per cent to 59,742 units, while the average residential price increased 6 per cent to $460,621 over the same period.

“Copyright British Columbia Real Estate Association. Reprinted with permission.”

Friday, October 10, 2008

G7 finance officials pledge action to stem financial crisis

Finance ministers, as well as bank heads from the Group of Seven countries — the most powerful economic nations in the Western world — pledged Friday to take "decisive action and use all available tools" to ease the crisis.

The group issued a five-point plan Friday evening after a meeting in Washington with U.S. Treasury Secretary Henry Paulson and U.S. Federal Reserve Chairman Ben Bernanke.

The measures include:

-Protection for major banks to prevent their failure.

-A commitment to help banks raise money from both public and private sources.

-A bolstering of deposit insurance.

-Help reviving the battered mortgage-financing market.

The Group of Seven countries are Canada, the United States, Japan, Germany, Britain, France and Italy. The finance officials are scheduled to meet with U.S. President George W. Bush Saturday at the White House.

Earlier in the day, Canadian Finance Minister Jim Flaherty announced his government's plan to buy the securities through the Canada Housing and Mortgage Corp. and provide much-needed cash to financial institutions that sell the so-called "National Housing Act mortgage-backed securities."

"This is going to make loans and mortgages more available and more affordable for ordinary Canadians and businesses," he said.

Flaherty, who attended the meeting in Washington, announced the new measures in an attempt to assuage concerns over the burgeoning global financial crisis and defuse criticism that the Conservative government was ignoring the spreading lending crisis.

He was expected to argue in Washington for tighter regulations of the kind that has kept Canada's banking system solvent in the middle of the global crisis.

Also Friday, Bush sought to assure the American public that governments worldwide were hard at work to counter the economic turmoil. He called for co-operation between the U.S. and other nations.

"We've seen that problems in the financial system are not isolated to the United States," he said in brief remarks from the White House Rose Garden.

"So we're working closely with partners around the world to ensure that our actions are co-ordinated and effective."

Members countries from the Group of 20 will meet with Paulson in Washington Saturday to discuss the crisis, which is also expected to dominate discussion at weekend meetings of the 185-nation International Monetary Fund and the World Bank in Washington.

CBC News Friday, October 10, 2008

Banks trim prime rate as Ottawa offers mortgage relief

TD Canada Trust and CIBC said it will lower the rate by another 15-hundredths of a point to 4.35 per cent, effective next Tuesday.

"We believe this initiative will be put into effect in a way that will reduce our overall cost of funds and, as a result we are dropping our rate today," Tim Hockey, president and CEO of TD Canada Trust, said Friday.

"Financial markets are very turbulent, and funding costs are still high. However, we anticipate that our cost of funds will decrease with the implementation of this program, and therefore wanted to take action that will benefit our customers directly."

The Bank of Nova Scotia, the Royal and the Bank of Montreal announced shortly afterward that they are cutting their prime rate by 0.25 points to 4.25 per cent.

Canada's big banks were under fire earlier this week after they decided to pass only part of the Bank of Canada's half percentage point rate cut to consumers. The banks said the decision was made because of volatile credit markets.

Speaking in Ottawa Friday, Flaherty said the decision to buy the mortgage debt from Canadian banks was being made in an effort to stabilize the lending industry and encourage lower interest rates.

Flaherty made the announcement before heading to Washington to meet with other G-7 finance ministers to formulate a plan for dealing with the current economic turbulence.

He said the mortgage debt will be purchased by the Canadian Mortgage and Housing Corp.

Flaherty said that will ease pressure on lending institutions and prompt banks to lower their interest rates for Canadians, which could spark renewed buying activity.

He said the plan is "efficient, cost-effective and safe way to support lending in Canada that comes at no fiscal cost to taxpayers."

Don Drummond, chief economist for TD, called the plan "music to my ears" and said it should benefit everyone involved.

"I don't think there's a risk of loss to the government, so it strikes me that those three partners -- the government, the CMHC and the banks all win and that helps ease up to some degree the credit flow in Canada," he told CTV's Canada AM.

Derek Holt, of Scotia Capital, said the move is a "healthy, positive step" designed to make loans available for those who qualify.

"That's the hope, that by taking mortgage backed securities out of the banking system that are illiquid, that they cannot move, cannot sell to the marketplace, and giving cash instead, that banks will then turn around and use that cash to generate more loan growth to businesses and households in Canada," Holt said.

Flaherty maintained the position the Conservatives have taken since the election campaign began -- that the economy is still strong and well protected from U.S.-style economic turbulence brought on my the sub-prime mortgage crunch.

He said Canadian banks and financial institutions are "sound and well-capitalized, and less-leveraged than their international peers."

Not a bailout

Prime Minister Stephen Harper has also sought to reassure Canadians that the economy is stronger than its U.S. counterpart, and will weather the economic storm.

Just yesterday, Harper said the government would not be providing a bailout to banks.

During a campaign stop Friday in Brantford, Ont., Harper said the deal to buy mortgages was an asset swap, not a bailout.

"The government's main concern right now is obviously the cost and availability of credit," Harper said Friday. "Part of what has been happening is, because of the problems in the banking systems around the world, there's less and less inter-bank lending and therefore credit conditions are becoming tight even in Canada.

"...What we're trying to do today is make sure that the banks can take some good assets and turn those into cash so they can make that available to small business, to people seeking mortgages."

The opposition has accused Harper of taking a "do nothing" approach, but he maintains his government has been quietly preparing for the slowdown and shouldn't take drastic reactionary steps now.

Flaherty said the mortgage buyout has been talked about for months.

Meanwhile, Liberal Leader Stephane Dion accused Harper of contradicting his own words about taking action on the economy.

"After months of saying no action was required and his approach was sufficient, it appears, four days before Election Day, Stephen Harper has now had a change of heart," Dion said in a statement Friday.

"It is no surprise that many Canadians will believe that the Conservatives are playing partisan politics with their mortgages and savings in the dying days of a federal election."

Dion said the "11th hour conversion" will not reassure Canadians that Harper understands their needs.

Fri. Oct. 10 2008 CTV.ca News Staff

Canada Mortgage and Housing Corporation Supports Canadian Credit Markets

The first purchase of $5 billion will be made October 16, 2008 through a competitive auction process. The mortgages involved are high-quality assets that are already guaranteed through government-backed mortgage insurance. The Government will announce a schedule of future purchase dates to take place over the coming weeks.

Canada Mortgage and Housing Corporation (CMHC) has been Canada’s national housing agency for more than 60 years. CMHC is committed to helping Canadians access a wide choice of quality, affordable homes, while making vibrant, healthy communities and cities a reality across the country.

CMHC OTTAWA, October 10, 2008

Thursday, October 2, 2008

New MLS® home listings down in August

“These days, REALTORS® in Canada face a lot of questions about the real estate market, real estate price bubbles, and the value of a home. That’s because we are at the end of an unusually active period in Canadian real estate – 2007 was a record year for many of the things we use to monitor the real estate market, including the average MLS® residential price,” said the President of The Canadian Real Estate Association, Calvin Lindberg.

“We must remember that all markets go through cycles, and remember that the national housing market is actually made up of different communities. Real estate markets are local, and every community, and every area, is different in terms of trends and pricing,” the CREA President added.

“Slower activity in some of Canada’s pricier housing markets compared to year-ago levels will continue weighing on the national average price,” explains CREA Chief Economist Gregory Klump.

“As our analysis shows, the Canadian housing market is stable and home sellers are not under pressure to sell. This is in stark contrast to the U.S. housing market, where there are a large number of distress sales. In Canada, with price gains diminishing and homebuyers taking more time to shop, the number of active MLS® listings may continue to ease so the Canadian housing market would stabilize further.”

CREA OTTAWA – September 30th, 2008

Friday, September 26, 2008

Big banks raise residential mortgage rates on longer-term loans

TD Canada Trust and Bank of Montreal said late Thursday they have raised mortgage rates by more than a third of a percentage point on three-, four- and five-year loans.

The changes reflect the rising cost of borrowing in the bond market, an inflation-sensitive financial marketplace where banks finance their mortgage lending.

Effective Friday, a five-year mortgage at both banks increases by .35 of a percentage point to 7.2 per cent, while a three-year closed term rises by the same amount to 7.05 per cent.

A one-year closed mortgage loan at TD Canada Trust falls by .3 of a percentage point to 6.35 per cent.

The changes suggest bond markets are worried about the future inflationary pressures from the proposed $700-billion U.S. government bailout of Wall Street banks, said TD Bank chief economist Don Drummond.

"We always did figure that adding $700 billion to the deficit of the United States would probably cause something like a 25 basis point [quarter point] increase in the longer-term interest rates and that seems to have already happened," said Drummond.

"[The bailout] does increase the risk to bonds. In just plain good old demand and supply that means there has to be an awful lot of bond issuance and there's a limited supply of people that want to buy them so it's natural that the price goes up," he added.

The interest rates on mortgages and other short-term borrowing are set based on the price of bonds. With lower demand for bonds and fears of inflation, rates have to rise to lure investors willing to part with their money.

Other interest rates in the economy — from consumer and car loans to mortgage rates tied to the prime rate — are affected by the Bank of Canada trend-setting rate, which is expected to fall or remain stable over the next few months at least.

On Thursday, U.S. congressional Republicans and Democrats reported agreement in principle on a bailout of the financial industry. They said they would present it to the Bush administration in hopes of a vote within days.

The bailout is expected to push up inflation and force the U.S. Federal Reserve Board to raise rates in the future.

Thursday's mortgage rate increases also come a day after the Merrill Lynch brokerage warned that Canadian households are so indebted that it's only a matter of time before the housing market turns down, as has already happened in the United States.

The Merrill Lynch Canada report by economists David Wolf and Carolyn Kwan acknowledged that the analysis is more pessimistic than the prevailing view. However, there are parallels with what happened in the United States in early-to-mid 2006 when housing prices started going down.

"There are parallels here and there is risk here that's perhaps not being properly acknowledged," said Wolf. "We may have started from a better place but Canadians are over time starting to borrow as much as Americans and the British."

© The Canadian Press, 2008

Thursday, September 18, 2008

Fewer Homes Being Added to the Market

Residential unit sales were down 47 per cent to 5,175 units during the same period. The average MLS® residential price in the province was $421,685, down 4.1 per cent from August 2007.

“Fewer home sales and larger inventories have tilted most BC housing markets in favor of homebuyers,” said Cameron Muir, BCREA Chief Economist. “However, a significant decline in new listings last month may be a signal that potential home sellers are now taking a wait and see approach.”

New MLS® residential listings in August fell 22 per cent from July on a seasonally adjusted basis, the second largest month-over-month decline in 25 years.

Compared to July, nearly 2,000 fewer active MLS® residential listings were available in the province, a decline of 3 per cent. “Home seller fatigue is now a possibility, as slower demand and competition among sellers lessen the chance of a timely sale,” added Muir.

Year-to-date MLS® residential sales dollar volume in the province declined 22 per cent to $25.4 billion compared to the same period last year. Transactions declined 27 per cent to 54,635 units, while the average residential price increased 7 per cent to $465,132 over the same period.

“Copyright British Columbia Real Estate Association. Reprinted with permission.”

MORTGAGE RATES STEADY INTO 2009

BCREA forecasts mortgage rates to remain near current levels, albeit with a slight upward trend through to the end of 2008 into 2009.

In a move widely expected by economists, the Bank of Canada (BoC) held its trend-setting interest rate at 3 per cent on September 3. This move came despite the recent slide in prices for commodities such as crude oil, a weak US economy and the continued slowdown in the Canadian economy that calmed inflationary pressures and fuelled speculation that rates may be cut. Financial markets had priced in the potential that the BoC would cut rates by 25 bps leading into the decision.

BCREA expects the BoC will keep its trendsetting trend setting overnight rate unchanged at 3 per cent through 2008 and into 2009 given BoC’s statement that the “target for the overnight rate remains appropriately accommodative.” BCREA expects an interest rate hike in the second half of 2009 in response to signs of a recovery in the US economy and higher US interest rates. The expectations of a future rate increase should provide upward pressure on Canadian mortgage rates as 2008 progresses.

However, BCREA anticipates improved credit market conditions to offset some of this increase. Tighter credit conditions have been the norm since August 2007 when the credit crunch drove up the cost of funds, including monies used to fund part of the mortgage loan market. This resulted in higher mortgage rates than would otherwise have been expected, given the historic relationships

between mortgage rates and yields on financial instruments with similar maturities. A recovery in the US economy will likely coincide with an improvement in credit market conditions, resulting in lower risk premiums which should partly offset the impact of higher interest rate expectations in Canada.

Inflation Risk Tempered by Crude Price

The accelerating pace of inflation is likely to slow in the coming months as energy prices moderate. Recently, higher inflation has been a concern as July’s total inflation breached 3 per cent for the second consecutive month and remained well above the BoC’s target band of 1 to 3 per cent. Despite a low core inflation rate, which excludes the most volatile items and is a good indicator of underlying inflation, the high headline rate fuelled speculation that rates could rise to stem inflationary pressures.

Rapid increases in energy prices have been the main contributor to higher inflation levels. The energy component of consumer price inflation increased by 21.1 per cent in July from a year earlier. Excluding energy, inflation amounted to only 1.6 per cent. However, after reaching $145 per barrel on July 14, the spot price of crude oil has tumbled 25 per cent to $109 at the beginning of September (Fig. 3). Crude futures for October delivery, the best indicator of future crude

price, has fallen below $105. This is well below the BoC’s projection of $140 assumed in its July Monetary Policy Update, and provides a cushion against upward inflation risk and interest rate hikes.

However, several factors may offset downward inflation pressure. The BoC noted volatility in commodity prices and global inflation in its September 3 communiqué. Additionally, while high crude prices have con contributed to a stronger Canadian dollar, a significant drop in the price of crude may have the opposite effect, resulting in higher import prices and inflation pressures.

The Canadian dollar continues to be historically high, but its value compared to the US dollar has declined nearly 6 per cent since July.

Economy Remains Soft in Q2

Canada’s economy remained sluggish in the second quarter, expanding at an annualized rate of 0.3 per cent. This followed a first quarter decline of 0.8 per cent. A relatively high Canadian dollar and softer US and global demand has resulted in a slowdown in export activity. However, domestic demand has remained strong despite a moderate slowdown in the second quarter. Overall activity was deemed by the BoC to be near production capacity, reflecting solid economic conditions in Canada.

In its September 3 communiqué, the BoC found that its current trend-setting interest rate was “appropriately accommodative.” The BoC expects total and core inflation will still converge to its target of 2 per cent by the second half of 2009. Given that the downside risks outlined in its Monetary Policy Update were realized, and the BoC still left rates unchanged, BCREA expects no

change in the rate until mid-2009 when economic growth is expected to improve. However, future rate increases should be offset in part by lower risk premiums, yielding stable mortgage rates for consumers.

“Copyright British Columbia Real Estate Association. Reprinted with permission.”

MLS® Home Sales Generate $2 Billion in GDP and 28,800 Jobs

“MLS® residential sales provide a significant contribution to BC economy,” said Cameron Muir, BCREA chief economist. Every 100 transactions in 2007 generated nearly $4.2 million in economic output and $2 million in GDP.

“While a single home sale has a relatively small impact, the cumulative effect of thousands of transactions is noteworthy,” added Muir. The province recorded 102,892 MLS® residential sales last year, contributing $4.3 billion to economic output and $2 billion to provincial GDP.

Home sales also create employment. For every 100 MLS® residential sales, 28 full-time equivalent (FTE) jobs were generated in 2007. This means 28,800 FTE jobs were needed to service the total number of MLS® residential sales last year.

100 typical MLS® residential transactions added nearly $1.3 million to household income. Total MLS® residential sales in 2007 contributed to more than $1.3 billion in BC household income.

Residential transactions generate significant tax revenue. Every 100 MLS® residential sales in 2007 accounted for nearly $300,000 in federal taxes, $660,000 in provincial taxes and $32,000 in municipal taxes. Total MLS® residential sales in 2007 generated approximately $300 million in federal taxes, $680 million in provincial taxes and $33 million in municipal taxes. In total, MLS® residential transactions contributed more than $1 billion to government coffers.

“Copyright British Columbia Real Estate Association. Reprinted with permission.”

Housing Starts Up in August

“After a brief pause in July, the volatile multiple segment bounced back to a level of activity that is more consistent with our forecast for this year,” said Bob Dugan, Chief Economist at CMHC's Market Analysis Centre. “Most of the volatility in housing starts over the last three months reflected swings in multiple starts in Ontario.”

The seasonally adjusted annual rate of urban starts rose 15.2 per cent in August compared to July. Both urban multiples and singles moved higher, with an increase of 25.2 per cent for multiples to 114,700 units, and a 2.0 per cent increase for singles to 71,200 units.

The seasonally adjusted annual rate of urban starts was down in every region except Ontario where housing starts jumped 81.0 per cent to 86,500. Urban starts sagged 22.5 per cent to 23,700 units in the Prairies and dropped 11.5 in Atlantic Canada. Smaller declines of 8.7 per cent and 8.2 per cent were recorded in Quebec (37,600 units) and British Columbia (30,400 units) respectively.

Rural starts were estimated at a seasonally adjusted annual rate of 25,100 units in August2.

For the first eight months of 2008, actual starts in rural and urban areas combined were down an estimated 4.3 per cent compared to the same period last year. Year-to-date actual starts in urban areas have increased by an estimated 1.0 per cent over the same period in 2007. Actual urban single starts for the January to August period of this year were 16.8 per cent lower than they were a year earlier, while urban multiple starts were up by 17.6 per cent over the same period.

CMHC September 9, 2008

Friday, August 29, 2008

New MLS® residential listing levels reach new heights in July

New MLS® residential listings numbered 80,147 units in July 2008, up 1.4 per cent from the previous month and 0.5 per cent above the previous record set in May 2008. This is the first time in any month that new listings surpassed eighty thousand units.

The number of new listings scaled to new heights in Ontario and Quebec, and in Manitoba climbed to their second-highest level since the beginning of the new millennium. This more than offset a monthly decline in the number of new listings in Alberta, where levels continue retreating from the peak reached in March.

Seasonally adjusted national sales activity in July 2008 was stable compared to the previous month. It has been holding steady since posting a 6.0 per cent month-over-month decline in February. Monthly activity rose in Alberta, Nova Scotia and Prince Edward Island for the second time in as many months. Activity also rose on a month-over-month basis in Newfoundland & Labrador. The monthly increase in activity in these provinces was offset by a monthly decline in activity in British Columbia, Ontario, and Quebec.

Sales activity set a new monthly record in Manitoba, and in Newfoundland & Labrador. It also climbed to its highest point on record for the year-to-date in these provinces.

Resale housing market balance is represented by sales as a percentage of new listings. The continuing rise in the number of new listings is resulting in a considerably more balanced resale housing market this year than buyers faced last year. This trend is most apparent in British Columbia and Saskatchewan, which remained the most balanced provincial markets in July. The market is showing signs of stabilizing in Alberta, where new listings have declined and market balance has tightened in each of the months from April to July 2008.

The national MLS® residential average price eased by 2.4 per cent year-over-year in July 2008, compared to the average price decline of 3.6 per cent in the major markets in Canada reported by CREA earlier this month. The MLS® price decline reflects softening average prices in Alberta and an increase in the province’s share of national sales activity compared to year-ago levels. By contrast, residential average price climbed to its highest level for the month of July in all other provinces except British Columbia, and its highest level ever in Newfoundland & Labrador. Average price for the year to date (as of July 2008) is 2.7 percent above where it stood over the same period last year.

Seasonally adjusted dollar volume for MLS® sales totaled $11.8 billion in July 2008, climbing to the highest level ever in Manitoba and Nova Scotia. It also reached the highest level on record for the month of July in Quebec, New Brunswick, and Newfoundland & Labrador. Volume for the year to date in July also achieved the second highest level on record, down 16.6 per cent from the peak last year.

"To keep things in perspective, 2007 was a record year for MLS® sales in Canada," says the President of The Canadian Real Estate Association, Calvin Lindberg. "The fact that sales volume continue at levels so close to that record year indicates what a dynamic and active real estate market there is in many regions of the country."

"The other factor is that the more listings there are on the market, the bigger the impact on the average price," the CREA President adds. "It means a market when buyers have more options, and sellers must be realistic in their pricing expectations. A REALTOR® has expertise and marketing resources to help both."

"The trend for new listings generally reflects recent price trends," said CREA Chief Economist Gregory Klump. "While still elevated, new listings in Alberta are easing and market balance is stabilizing now that prices there have softened. Similar trends are expected to play out in other western provinces where prices posted sharp gains last year," he said.

“Copyright British Columbia Real Estate Association. Reprinted with permission.” August 29, 2008

Monday, August 18, 2008

An Excellent Time to Buy or Sell

But the future is not as bleak as it appears. Our adjusting real estate market is not a disaster. This correction is needed to help create a healthier, balanced market.

For Sellers current market conditions simply means that they must price their home right. Sellers must accept that their house will not sell for as much as it would have last year and that to influence a quick sale, the really anxious seller may even have to further reduce the price. Properties are now taking longer to sell. Pricing a property correctly is still the best way to reduce the stress of selling.

In addition to selecting an appropriate asking price, the condition of the property is key to achieving the quickest sale for the highest price and most favorable terms. Staging is now more critical then in previous years when a house in any condition would sell quickly just because there was nothing else available. Today sellers need to remove clutter and make repairs. A well maintained and well presented home will out sell the properties where work has been deferred. The balance of power has levelled but sellers still maintain control of the condition and price of a property.

For buyers the new market conditions provides them with the time that they need to make an informed decision. I never enjoyed having to say to a buyer, "if you like this house you will need to act quickly, by tomorrow it will likely be sold." But that was the reality of the 2005-2007 Nelson, BC real estate market.

The reality for buyers in 2008 is no pressure to compete, an increase in supply and time to consider a purchase rationally. Now is the time for buyers to seriously consider purchasing a home.

Kootenay Real Estate Board Stats July 2008

Listing numbers in July were up 17% over last year, Year to Date listing numbers are up 24.8%.

Listing Inventory is up 69% over last year at the end of July.

Swollen Inventories Favour Homebuyers

“The slowdown in housing demand has swollen the inventory of homes for sale, putting downward pressure on home prices in some markets,” added Muir. A total of 60,008 homes were for sale on the MLS® in July, an increase of 63 per cent from the previous year. “While this inventory is expected to decline in the coming months, most BC regions will remain in buyers’ market territory for the remainder of 2008.”

Year-to-date MLS® residential sales dollar volume in the province declined 18 per cent to $23.2 billion compared to the same period last year. Sales transactions fell 24 per cent to 49,448 units, while the average residential price increased 8.2 per cent to $469,676 over the same period.

“Copyright British Columbia Real Estate Association. Reprinted with permission.” August 15, 2008

Monday, August 11, 2008

Housing Starts Down in July

“After a strong first half of the year, the volatile multiple segment is now readjusting itself.” said Brent Weimer, Senior Economist at CMHC’s Market Analysis Centre. “This brings activity since the start of the year closer in line with our 2008 forecast of more than 200,000 housing starts for the seventh consecutive year.”

The seasonally adjusted annual rate of urban starts decreased by 14.8 per cent in July compared to June. Both urban multiples and singles moved down, with a drop of 20.2 per cent for multiples to 91,600 units, and a 6.6 per cent decline for singles to 69,800 units.

The seasonally adjusted annual rate of urban starts went down in Ontario and to a lesser extent in the Prairies, where housing starts decreased by 38.8 per cent to 47,800 and by 1.6 per cent to 30,600 in July, respectively. Urban starts increased slightly by 2.2 per cent to 41,200 units in Quebec, by 2.4 per cent to 8,700 units in Atlantic Canada, and by 5.1 per cent to 33,100 units in British Columbia. While single starts decreased in all regions in July, with the exception of the Atlantic Canada where they remained unchanged, multiple urban starts only registered a decline in Ontario.

Rural starts were estimated at a seasonally adjusted annual rate of 25,100 units in July2.

For the first seven months of 2008, actual starts in rural and urban areas combined were up an estimated 2.3 per cent compared to the same period last year. Year-to-date actual starts in urban areas have increased by an estimated 2.4 per cent over the same period in 2007. Actual urban single starts for the January to July period of this year were 15.5 per cent lower than they were a year earlier, while multiple starts were up by 19.0 per cent over the same period.

CMHC OTTAWA, August 11, 2008

Wednesday, July 30, 2008

Mortgage Rates from Invis

6 MONTHS - 6.20% - 6.20%

1 YEAR - 6.95% - 5.05%

2 YEARS - 7.00% - 5.50%

3 YEARS - 7.00% - 5.50%

4 YEARS - 6.99% - 5.50%

5 YEARS - 7.15% - 5.64%

7 YEARS - 7.60% - 6.20%

10 YEARS - 7.95% - 6.25%

Friday, July 25, 2008

2008 Mid Year numbers resemble “Buyers Market”.

Kootenay Real Estate President Andrew Smith says “The real estate market in the Kootenay’s are generally in a “buyers market” state with inventories of active listings on the MLS® increasing 71% over active MLS® listings to the end of June 2007. The market situation that is out of sync with a “buyers market” is the total general average price per unit increase of 16%. Some markets are seeing a decline in average price per unit, but generally, values are holding and statistically are increasing in spite of high inventory levels and a decline in MLS® unit sales.”

MLS® Dollar Volume of all sales processed through the Kootenay Real Estate Board Year to Date to the end of June 2008 are sitting at $439,081,617, a decline of 24% over the same reporting period last year.

Kootenay Real Estate Board President Andrew Smith further says: “REALTORS® in the Kootenay’s expected that the real estate markets would slow in 2008 given the records set in 2007. 2008 is shaping up to be the year the markets take a rest from the unprecedented price gains of the last few years and in general, it’s healthy for markets to pause and cycle. The statistics are showing that even with the declines, values are staying strong. That should give consumers confidence we are not experiencing the same type of a decline as the US real estate market and that the value of their real estate is still strong.”

MLS® Unit Sales in June 2008 declined 37% from amounts reported in June 2007. MLS® Sales year to date to the end of June 2008 show a decline of 34% over MLS® sales to the end of June 2007.

The price of the average residential detached house sold on the Multiple Listing Service® in June 2008 rose by 7% to $334,303 compared to June of 2007. Year to Date comparisons to the end of June 2008 saw values increase to $321,419, an average increase of 15% over the same reporting period last year.

Kootenay Real Estate Board MLS® statistics for 2008 year to date show residential detached housing listings up 21% over the same period in 2007 with MLS® unit sales for detached residential housing showing a decline of 37% over amounts reported last year.

Overall, the number of MLS® listings in 2008 year to date to the end of June increased 27% over the same period in 2007, with overall MLS® unit sales down 34% over the same period in 2007.

When asked to comment on what residents of the Kootenays should expect for their real estate markets in for the remainder of 2008 President Andrew Smith had this to say:

“From an MLS® unit sales perspective we are seeing performance at about 2004 levels. The unexpected factor this year so far are the average price per MLS® unit sale increases. Not all ends of the market are seeing increases, but the common trend is that real estate continues to be an appreciating asset.”

KREB MEDIA RELEASE Nelson. BC July 11, 2008

Monday, July 21, 2008

New law requires real estate agents to verify ID of clients

These new regulations are part of federal legislation (Bill C-25) passed in 2007 that requires a number of industries, including real estate, to do more to help stop money laundering and terrorist financing. The regulations are enforced by the federal agency known as the Financial Transactions and Reports Analysis Centre of Canada, or FINTRAC.

"Real estate agents have had legal obligations under the federal government's push to prevent criminal activity and terrorism since 2001, when Canada’s first comprehensive laws to combat money laundering and terrorist financing were introduced," says the President of The Canadian Real Estate Association, Calvin Lindberg. He is a REALTOR® in Vancouver.

“In the first phase of compliance, real estate agents were required to report only suspicious transactions, or transactions involving more than $10,000 in cash,” the CREA President explains. “Now, verified personal information must be kept of the buyer and seller for each and every real estate transaction in Canada. That personal information includes details such as occupation.”

Real estate agents are now required to ask for proof of the identity of all buyers or sellers involved in a Canadian real estate transaction. If the client is a corporation, that information must include corporate documentation, and the names of the corporation directors. They must also ascertain if a third party is involved in the transaction.

This also applies if a buyer or seller involved in a transaction is not represented by a real estate agent, but the other individual involved is represented. Those buying or selling privately will be asked by the agent representing the other party involved in the transaction to provide proof of identity as well, and that record must be kept by the real estate agent involved in the transaction.

Also under the new FINTRAC regulations, real estate agents dealing with clients they never meet must also verify personal information. The broker office involved can do this with a service agreement with an agent or mandatary in the area where the client is located. That agent or mandatary must then meet the client, verify the identification of the client, and provide the information to the broker office actually handling the real estate transaction.

“There are buyers, sellers or investors from other countries who rely on expertise here rather than visiting the property themselves,” the CREA President explains. “They must now meet with an official agent of the Canadian broker, and provide proof of identity. This agreement will add to the business costs of the Canadian broker.”

In addition to verification of personal information, real estate agents must also complete a report on the receipt of all funds received during the real estate transaction, not just those of $10,000 or more.

In order to comply with these new federal regulations, real estate agents are required to keep this identification and receipt of funds information on file for five years and provide it to FINTRAC if requested. It is the individual broker office that will be responsible for the safe keeping of the information, and the brokerage that will have to respond to any FINTRAC information request.

There were 559,325 transactions reported through the Multiple Listing Service® operated by local real estate Boards and Associations in 2007.

The Canadian Real Estate Association (CREA) is one of Canada’s largest single industry trade associations, representing more than 96,000 REALTORS® working through more than 90 real estate Boards and Associations. CREA’s primary mission is to represent members at the federal level, and to defend the public’s right to own and enjoy property.

Bob Linney, CREA Communications Director

Fewer Sales and Large Inventory Cool Housing Market

"Weaker consumer confidence and eroded affordability are slowing home sales in the province," said Cameron Muir, BCREA Chief Economist.

Seasonally adjusted MLS® residential unit sales in June were near 2002 levels. During the first half of the year, BC MLS® residential sales were down 22 per cent to 42,907 units, when compared to the same period last year. The average residential price rose 9.6 per cent to $473,536 over the same period.

"The combination of a larger inventory of homes for sale and fewer home sales have tilted most BC markets in favour of homebuyers," added Muir. "This means little upward pressure on home prices in many markets." Victoria was in balanced conditions, while Northern Lights remained a sellers’ market in June. "Despite a dip in home sales, inventories could soon edge lower as home sellers adjust their asking prices to reflect market conditions."

“Copyright British Columbia Real Estate Association. Reprinted with permission.” Vancouver, BC – July 16, 2008

Friday, July 18, 2008

Make a few extra $ by recycling your old fridge

Since 2002, more than 175,000 fridges have been picked up and recycled by BC Hydro Power Smart’s Refrigerator Buy-Back Program. This program provides the resources to safely recycle the ozone-depleting refrigerant and metal in fridges by using environmentally sound methods—and BC Hydro pays $30 per fridge.

If all fridges that have been picked up by BC Hydro since 2002 were laid down head to toe they would cover a distance of over 320 kilometres (based on the average fridge being 182.88 cm high). They would cover the highway distance from Burnaby to Manning Park.

British Columbians can arrange for the free pick-up of a second operating household fridge by calling 604.881.4357 or 866.516.4357 for residents outside the Lower Mainland.

To learn more about ways to conserve energy in everyday life, as well as BC Hydro’s Power Smart residential programs such as mail-in rebates, ENERGY STAR® windows, PST exemptions and Power Smart New Homes, visit www.bchydro.com/powersmart.

“Copyright British Columbia Real Estate Association. Reprinted with permission.”

A market shift = a shift in expectations

Residential sales have declined 22 per cent in the first six months of this year, while available resale inventory has grown by 54 per cent to 57,000 active listings in June. In the Greater Vancouver board area, where longer-term data is available, inventory is at the highest level since 1998.

Home price appreciation observed from 2004 to 2007 is less attainable in today’s market, and sellers’ expectations for such gains should be tempered. More generally, in a market favouring buyers, prices generally increase at or below the level of inflation. While the average residential home price in BC increased at a healthy 6 per cent per year since 1981, large gains are often followed by periods of price stagnation. Over-optimistic pricing by sellers will only inhibit the timely sale of properties, adding to inventory levels.

Buyers have more homes to choose from now than in previous years, resulting in greater freedom to compare the attributes and prices of similar properties in the market before making purchase decisions.

Despite current buyers' market conditions fuelled by housing affordability constraints and economic uncertainty, the economic and demographic backdrop in support of housing demand remains strong in BC. BC's unemployment rate remains near record lows, while the labour force participation rate hovers near historical highs. Meanwhile, the province remains a favoured destination for new migrants, reflected in the third-highest population growth among provinces during the first quarter of 2008. However, challenges continue in the forestry sector, and eroded consumer confidence may also be playing a role in a pull back of consumer spending.

“Copyright British Columbia Real Estate Association. Reprinted with permission.”

Monday, July 14, 2008

New Mortgage Market Regulations Coming

Additionally, government-backed insurance will be limited to mortgages with a loan-to-value ratio up to 95 per cent, down from the current 100 per cent. Other regulatory changes include the establishment of a credit score floor, loan documentation to ensure there is reasonableness of property value, borrower's sources and level of income. Mortgage insurance on high-ratio mortgages that don’t require amortization in the first few years from the government guarantee (i.e., interest only products) won’t be backed, and a maximum of 45 per cent on a borrowers' total debt service ratio will be set.

The new regulations apply only to new mortgage originations, while existing originations will be unaffected. The lag period prior to the regulatory change will allow existing mortgage pre-approvals to be used or expire. All mortgage insurance companies will be affected by this regulatory change.

As Canada Mortgage and Housing Corporation (CMHC) is a Crown corporation, the government is ultimately responsible for CMHC's obligations, including mortgage insurance claims. Hence, CMHC will no longer offer 40-year amortization and 100 per cent loan-to-value ratio mortgage insurance products, given the new regulations. In addition, the government also backs private insurers' obligations to lenders in the event of default, provided the business is eligible to the guarantee, but claims are subject to a 10 per cent deductible of the original principal amount of the loan agreement. Private insurers include firms such as Genworth, United Guarantee and PMI.

Private insurers are still free to insure 40-year amortization and 100 per cent loan-to-value mortgage products, but the lack of government backing will lead to sizeable increase in risk. This may mean the elimination of these products after October 15, or a higher insurance cost for the borrower.

“Copyright British Columbia Real Estate Association. Reprinted with permission.”

Housing Starts Remain High in June Despite Decrease

“Despite the decrease in June, total housing starts remain at high levels.” said Bob Dugan, Chief Economist at CMHC’s Market Analysis Centre. “This is mostly due to the multiple segment which has been continuously above the 100,000 unit threshold since the beginning of the year.”

The seasonally adjusted annual rate of urban starts moved down by 5.0 per cent in June compared to May. Both urban multiples and singles decreased, with a decline of 3.0 per cent for multiples to 114,700 units, and a 7.8 per cent drop for singles to 74,600 units.

The seasonally adjusted annual rate of urban starts went down in all regions of Canada, except Ontario, where housing starts increased by 10.8 per cent to 77,900 in June. Urban starts declined to 8,500 units in Atlantic Canada, 40,300 units in Quebec, 31,200 units in the Prairies, and 31,400 units in British Columbia. Both single and multiple urban starts decreased in all regions in June, with the exception of multiple starts in Ontario which increased by 30 per cent.

Rural starts were estimated at a seasonally adjusted annual rate of 28,500 units in June2.

For the first half of 2008, actual starts in rural and urban areas combined were up an estimated 1.5 per cent compared to the same period last year. Year-to-date actual starts in urban areas have increased by an estimated 6.1 per cent over the same period in 2007. Actual urban single starts for the first six months of this year were 13.1 per cent lower than they were a year earlier, while multiple starts were up by 23.1 per cent over the same period.

1. All starts figures in this release, other than actual starts, are seasonally adjusted annual rates (SAAR) — that is, monthly figures adjusted to remove normal seasonal variation and multiplied by 12 to reflect annual levels.

2. CMHC estimates the level of rural starts for each of the three months of the quarter, at the beginning of each quarter. During the last month of the quarter, CMHC conducts the survey in rural areas and revises the estimate.

CMHC Ottawa July 9, 2008

Monday, July 7, 2008

Current Market Conditions

When asked these days "What is the market doing?" My response is "resting." Although organizations like CMHC are still calling for positive gains this year, prices have been at a stand still since the end of last year.

Buyer's are approaching the market cautiously with a "Let's just wait and see" attitude. The spring of 2008 was certainly slow and it has only been over the past few weeks that we are seeing any sign of fair weather real estate rush.

According to KREB year-to-date sales statistics to June 1st, our average sales price of a single family home in Nelson was up from $311,930 in June of 07 to $361,405 in June of 08 however the total number of sales was down from 89 to 63 and dollar volume was down from $24,762,800 to $20,342,825.

In Nelson Rural the average home prices have increased from $345,980 to $401,278 but total sales have also dropped from 97 to 76.

In Kaslo the price of a single family home increased on average from $218,500 to $315,000 but sales have dropped from 20 to 8.

And in Salmo we have had the average home sale increase from $195,785 to $261,740 but again total sales have dropped from 9 to 5.

So what does this all mean. It shows that we have a much more balanced market that requires Sellers to be more accurate when pricing a home to sell. The market is no longer racing to catch up with overpriced properties. For buyers they now have more product to be able to compare a property to and they have the time to make better informed decisions. It is still a great market for Selling and Buying but conditions have definitely changed from a year ago.

Let me know if you would like a copy of my sales state comparison.

Source KREB YTD Stats to May 2008

Monday, June 16, 2008

Valhalla Path Realty

Friday, June 13, 2008

Home listings flood market

There were 54,029 new listings of resale housing units in major markets last month, a 2.2 per cent increase over the seasonally adjusted record hit in April, according to data released Friday by the Canadian Real Estate Association (CREA).

On an unadjusted basis, listings rose to 67,628 units, up 7 per cent from May 2007.

Unlike listings, year-over-year sales levels fell in 18 of the 20 markets in the study for which data were available. Information was not available for the Quebec markets because geographical areas in the province are being redefined.

Unit sales across Canada dropped by 17 per cent this May from the year before on an unadjusted basis, and by 0.5 per cent compared with April, 2008, on a seasonally adjusted basis.

Prices edged up 1 per cent in May from the year before to $337,071, a new record for the average price, but the smallest such increase in more than seven years.

“Rising food, fuel and home prices are denting consumer confidence. Increasingly cautious home buyers may keep listings on the market longer before being sold, which increases the importance of realistic pricing,” Gregory Klump, chief economist at CREA, said in a statement.

The most dramatic surges in new listings occurred in Saskatoon and Regina, a marked reversal from earlier in the year when they were the country's tightest markets in terms of supply.

New resale listings rose by 58 per cent in Regina and 44 per cent in Saskatoon year-over-year in May. During the same month, year-over-year sales fell in those markets by 28 per cent and 37 per cent respectively.

This pattern has already been seen in other markets including Calgary and Edmonton, where tight supply and soaring prices have given way to a cool-down.

Listings in those markets are now retreating from the peak levels reached in March as the market readjusts, with listings up 1 per cent in Calgary and down 9 per cent in Edmonton from the year before.

“It is now becoming increasingly clear that the Canadian housing market is gradually cooling off, with the decline in activity in the West particularly pronounced,” said TD Securities economics strategist Millan Mulraine. “However, we believe that the sector will remain in reasonable shape, and will avoid any U.S.-style housing correction.”

CREA characterized Calgary, Edmonton and Windsor, Ont., – the only three markets where home prices dropped year-over-year in May – as the country's three “most balanced major markets.”

Other data included in the report (all figures compare May, 2008 with May, 2007):

– Markets with the largest increases in listings: Regina (+58 per cent), Saskatoon (+44 per cent), Greater Vancouver (+20 per cent), Victoria (+20 per cent), Sudbury, Ont. (+16 per cent), Ottawa (+16 per cent).

– Markets with the largest drops in listings: Edmonton (-9 per cent), Windsor-Essex (-6 per cent), Newfoundland and Labrador (-6 per cent).

– Markets with the largest decreases in sales: Saskatoon (-37 per cent), Edmonton (-35 per cent), Calgary (-33 per cent), Greater Vancouver (-31 per cent), Regina (-28 per cent).

– Markets with increases in sales (2 of 20): Newfoundland and Labrador (+5.5 per cent), Ottawa (+2.5 per cent).

– Markets with the largest increases in unit price: Regina (+45 per cent), Saskatoon (+29 per cent), Saint John (+22 per cent), Newfoundland and Labrador (+21 per cent).

– Markets with decreases in unit price (3 of 20): Windsor-Essex (-6 per cent), Edmonton (-5 per cent), Calgary (-2 per cent) .

LORI McLEOD, Globe and Mail Update

Tuesday, June 10, 2008

Balance returns to recreational property markets across Canada this year, says RE/MAX

The RE/MAX Recreational Property Report found that a substantial increase in the supply of recreational properties listed for sale, combined with fewer buyers overall, characterized most recreational markets this year. Of the 45 markets surveyed, 91 per cent (or 41 markets) were in the transition stage, moving from strong sellers into balanced market conditions. The only exceptions were Salt Spring Island, two markets in Saskatchewan—Last Mountain Lake and Qu’Appelle Lakes and Lakes Candle, Emma, and Waskesiu -- and Newfoundland’s East Coast —where inventory levels were relatively low. Affordability was a primary factor in 35 per cent of markets surveyed, given serious upward pressure on recreational values in recent years.

“We’re coming off the longest period of economic expansion since World War II,” says Elton Ash, Regional Executive Vice President, RE/MAX of Western Canada. “Recreational property values have appreciated beyond our wildest dreams across the country. More balanced market conditions are a welcome change for purchasers.”

Adverse winter weather conditions during the first four months of the year hindered recreational activity. Sixty-seven per cent of markets reported softening in the number of sales year-to-date, while average prices remained stable or experienced moderate increases over 2007 levels for the same period. Economic concerns, fueled by negative GDP growth in the first quarter and soaring energy costs, have also played a role in the transitioning market.

“Market conditions have shifted, but don’t expect to see bargain basement prices or fire sales,” says Michael Polzler, Executive Vice President and Regional Director, RE/MAX Ontario-Atlantic Canada. “The recreational market continues to experience solid demand -- a trend that is expected to continue throughout 2008. The influx of new listings has yet to translate into downward pressure on recreational property prices. Prime waterfront properties, while more plentiful than in year’s past, will still command top dollar.”

For the first time in many years, in fact, a good selection of entry-level waterfront is available in markets across the country. Eighteen per cent of those surveyed offer properties under the $200,000 price point, including; Central South Cariboo in British Columbia; Parry Sound, East Kawarthas and Kingston in Ontario; Summerside, PEI; South Shore, Nova Scotia; Shediac, New Brunswick; and the East Coast of Newfoundland.

Recreational property buyers also found themselves divided between two borders this year. The housing market meltdown in the US combined with a Canadian dollar at par created serious investment opportunities for secondary properties in Florida, Arizona, Texas, and California. Some of those very same factors have spurred American recreational property owners in Canada to list their properties for sale, with many looking to take advantage of ideal market conditions here.

“Many Canadians are capitalizing on market conditions in major American centres,” says Polzler. “For some purchasers, the move is strictly a short-term investment strategy with a pay-off at the end of the day, while for others, retirement is the main objective.”

The report also found that younger buyers were a factor in 40 per cent of recreational markets surveyed.

“Baby boomers are clearly not the only purchasers that appreciate the recreational lifestyle,” says Ash. “Generation X is quickly becoming a force in the marketplace, spurring demand for condominium product on ski hills, oceanfront properties in good surf locales, and water frontage on trendy lakes with celebrity residents.”

Other highlights:

-Alberta’s red-hot economy has helped boost recreational property markets in British Columbia, Atlantic Canada, and some parts of Ontario.

-Affordability is prompting buyers to consider back lots, riverfront, condominiums, hobby farms and leased land.

-Some purchasers looking to secure an exit strategy are buying recreational properties or secondary homes in residential neighbourhoods in close proximity to the water’s edge.

RE/MAX Western Canada June 10,2008

Bank of Canada holds line on interest rates

The central bank left the overnight rate — what the country's big banks charge each other for overnight loans — steady at three per cent.

Many economists had forecast a cut of a quarter of a percentage point.

"The Bank of Canada proved today that it has a mind of its own," said Beata Caranci, the director of economic forecasting at TD Bank.

The Canadian dollar shed 0.08 of a cent to settle at 97.81cents US.

The Bank of Canada is currently grappling with mixed signals — a slowing economy and inflation tensions.

The country's GDP unexpectedly contracted by 0.3 per cent annualized in the first quarter. Housing is cooling, last month's job-creation figures were the lowest this year, and a couple of recent surveys indicate consumer confidence in Canada has fallen to a six-year low.