Nelson BC real estate blog by Robert Goertz of Valhalla Path Realty. Keeping you up to date with the Nelson and West Kootenay real estate markets.

Friday, December 25, 2015

Wednesday, December 23, 2015

Canada GDP, Retail Sales, Employment

The Consumer Price Index

Monday, December 14, 2015

MORTGAGE RATES SET FOR MODEST RISE IN 2016

Canadian Housing Starts

Canadian Government Change to Minimum Down Payment on Insured Mortgages

November Home Sales Second Strongest on Record

The British Columbia Real Estate Association (BCREA) reports that a total of 8,032 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in November, up 34.5 per cent from the same month last year. Total sales dollar volume was $5.38 billion, up 56.4 per cent compared to the previous year. The average MLS® residential price in the province rose to $668,317, up 16.3 per cent from November 2014.

“Housing demand last month was the second strongest ever recorded for the month of November,” said Cameron Muir, BCREA Chief Economist. “You’d need to look all the way back to the frenetic market of 1989 to find more homes trading hands in November.“

The largest increase in consumer demand occurred in the Fraser Valley, where home sales climbed over 60 per cent from November 2014. Vancouver and Chilliwack experienced an increase of over 40 per cent, while Kamloops home sales were up 30 per cent.

The year-to-date, BC residential sales dollar volume increased 35.4 per cent to $60.7 billion, when compared with the same period in 2014. Residential unit sales climbed by 21.5 per cent to 95,927 units, while the average MLS® residential price was up 11.4 per cent to $632,209.

Copyright BCREA - reprinted with permission

Friday, December 4, 2015

CLI Points to Stable Commercial Real Estate Activity Next Year

Will Interest Rates Rise or Will They Fall?

Creating Sustainable Neighbourhoods

- Trees shading your house can make it

feel cooler in the summer. Healthy trees also increase your property

value. They intercept rainwater, improve air quality, and make streets and

public spaces more comfortable and attractive.

- Asphalt surfaces, like parking lots,

can make urban areas hotter than the surrounding countryside in the

summer. With less asphalt surface, neighbourhoods are more attractive and

land-efficient. In mixed-use neighbourhoods, fewer parking spots are

needed because places with high daytime needs, like offices, are close

enough to share parking with places that need more parking at night, like

homes and restaurants.

- Cars are a major source of smog in

urban areas, so driving less helps everyone’s health, particularly

children, the elderly and people at risk for cardio-respiratory problems.

- Half of the greenhouse gases from

energy use by individual Canadians come from passenger road

transportation, like cars. In the Toronto area, greenhouse gases from

weekday passenger travel generated by people living in mixed-use,

pedestrian and transit-friendly neighbourhoods near the urban core are

about 1/3 of those by people living in dispersed, strictly residential

neighbourhoods on the urban fringe.

Canadian and US Employment

Wednesday, December 2, 2015

Bank of Canada Interest Rate Decision

The Bank of Canada announced this morning that it is maintaining its target for the overnight rate at 0.5 per cent. In the press release accompanying the decision, the Bank noted that inflation is in line with its outlook with total CPI inflation near the bottom of the Bank's 1 to 3 per cent target range while core inflation remains close to 2 per cent. On growth, the Bank cited ongoing and complex adjustments in the Canadian economy to low commodity prices, but expects growth to move above potential (usually estimated to be about 2 per cent) in 2016.

Absent a substantial recovery in global commodity prices, the Canadian economy will more than likely grow near its long-term trend rate over the next two years. That rate of growth will keep inflation relatively anchored at or below its 2 per cent target. A baseline scenario of economic growth above 2 per cent, paired with low inflation and steady job growth should keep the Bank of Canada sidelined over the medium run. However, several quarters of steady growth following the oil price shock of late 2014 may convince policymakers that the economy is no longer in need of the monetary stimulus injected into the economy via two rate cuts in early 2015. If so, the Bank may shift back to a tightening bias with a potential rate increase late next year or in early 2017.

Copyright BCREA- reprinted with permission

Tuesday, December 1, 2015

Canadian Economic Growth (Q3'2015)

Friday, November 20, 2015

Canadian Retail Sales

Given today's data release, Canadian real GDP is currently tracking at about 2.5 per cent in the third quarter, while the BC economy is on pace to grow 2.8 per cent for all of 2015.

Monday, November 16, 2015

Robust Housing Demand Continues in October

Canadian Manufacturing Sales

Canadian manufacturing sales declined 1.5 per cent in September, the second consecutive monthly decline. Lower sales were the result of ongoing weakness in the energy sector as well as falling demand in the motor-vehicle industry. Overall, sales were lower in 13 of 21 Canadian manufacturing sub-sectors, representing about 80% of Canadian manufacturing output.

In BC, where the manufacturing sector employs roughly 170,000 people, sales rose 0.2 per cent on a monthly basis but were down 0.6 per cent compared to September 2014. BC manufacturing sales are being led by growth in shipments of wood products to the United States as well as strong demand for BC made machinery and equipment. Those sectors are helping to offset current weakness in commodity prices to produce growth of 3 per cent in manufacturing sales year-to-date.

Copyright BCREA - reprinted with permission

Tuesday, November 10, 2015

Housing Demand to Ease but Remain Elevated in 2016

Monday, November 9, 2015

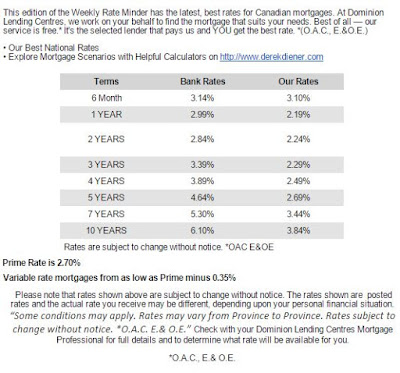

Best Rate Mortgages

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

Canadian Housing Starts

Canadian housing starts moderated from a very strong September, falling close to 15 per cent to a still robust 198,065 units at a seasonally adjusted annual rate (SAAR) in October. The six-month trend in Canadian housing starts of 206,089 units SAAR continues to rise and is currently above the rate of household formations in Canada, a sign that new home construction could slow next year.

Housing starts in BC were up 21 per cent from September, rising to 33,737 units SAAR. On a year-over-year basis, housing starts were up 48 per cent with single detached starts falling 2 per cent year-over year while multiple unit starts jumped 83 per cent compared to October 2014. Year-to-date, total housing starts in BC are up 13 per cent compared to 2014.

Looking at census metropolitan areas (CMA) in BC, total starts in the Vancouver CMA were up 70 per cent year-over-year in October as a result of a sharp rise in the construction of multiple units, which more than doubled compared to October 2014. In the Victoria CMA, the rate of new home construction was also more than double the rate of last October with both single and multiple starts posting strong growth. Total housing starts in the Kelowna CMA were up 30 per cent year-over-year on broad strength in both single and multiple unit starts. Housing starts in the Abbotsford-Mission CMA were up close to 90 per cent compared to this time last year largely on strong growth in single unit starts.

Copyright BCREA - reprinted with permission

Thursday, October 29, 2015

US Economic Growth (Q3'2015)

Today's disappointing economic growth numbers should temper expectations for a December rate hike by the US Federal Reserve. If the Fed does indeed decide to tighten monetary policy at its final meeting in 2015, it is increasingly unlikely that that decision will be supported by trends in growth and inflation, but rather by a long-held desire to move rates off of the zero lower bound.

US Federal Reserve Interest Rate Decision

Most economists agreed that the Fed was unlikely to raise rates at the October meeting, preferring to wait until December before initiating a lift-off from the zero rate policy that has prevailed since 2008. A global economic slowdown since the summer has provided a significant amount of cover for the Fed to put off raising rates until it can better grasp the impact of slower global growth and a high US dollar on the US economy. The Fed also wants to be "reasonably confident" that its preferred measure of inflation, which is currently tracking at just 1.4 per cent, will reach 2 per cent over the medium-term, usually defined as about 2 years. Our modeling suggests a somewhat low-probability that inflation will reach 2 per cent before the end of 2016. If that holds, and the Fed puts off tightening longer than currently expected, key bond yields in both the US and Canada should remain low, meaning low mortgage rates will continue throughout next year.

Thursday, October 22, 2015

Canadian Retail Sales

Wednesday, October 21, 2015

Bank of Canada Interest Rate Decision

Growth in the Canadian economy appears to be firming in the second half of the year. Third quarter real GDP growth is currently tracking at 2.5 per cent on an annual basis and core inflation continues to hover near the Bank's target of 2 per cent. Moreover, the outlook for growth next year may be somewhat brighter than the Bank currently forecasts given the spending intentions of the new Canadian government. If so, some of the burden on monetary policy will be lifted, making further rate cuts less likely. We expect that the Bank will remain on hold through the rest of 2015 and much of 2016, with a chance of tighter monetary policy toward the end of next year.

Copyright BCREA - reprinted with permission

Tuesday, October 20, 2015

Monday, October 19, 2015

Strong Housing Demand Pulls Inventory to an Eight Year Low

Copyright BCREA – Reprinted with permission

Canadian Manufacturing Sales

Canadian Employment

Canadian Housing Starts

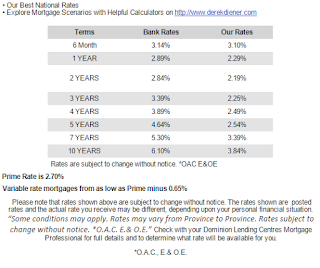

Dominion Lending Best Rate Mortgages

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

Wednesday, September 30, 2015

Canadian Retail Sales

In a further sign that the Canadian economy is recovering, Canadian retail sales rose 0.5 per cent in July, the third consecutive monthly increase. On a year-over-year basis, sales were up 1.8 per cent. Retail sales were higher in 6 of 11 retail sub-sectors with sales of motor vehicles and clothing leading the way. In BC, retail sales dipped 0.4 per cent on a monthly basis but were up 5.7 per cent compared to July 2014.

Consumer spending continues to be the main driver of economic growth in Canada, though weakness in the loonie is helping export growth. Canadian real GDP is currently tracking at between 2 and 2.5 per cent in the third quarter which would mean an end to the "technical" recession experienced over the first half of the year.

Canadian Monthly GDP

The Canadian economy grew faster than expected in July with output expanding by 0.3 per cent on a monthly basis. Growth in real GDP, as measured at the industry level, was led by gains in the mining, oil and gas sectors as well as rising output in the manufacturing and finance and insurance sectors.

Solid economic growth in July comes on the heels of very strong growth in June and generally encouraging economic data since the beginning of summer. July's GDP data also signals a high likelihood that third quarter economic growth will not just be positive, therefore breaking a string of two straight down quarters, but will register a fairly robust 2.5 per cent.

Copyright BCREA - reprinted with permission

Friday, September 18, 2015

Canadian Consumer Price Inflation

Thursday, September 17, 2015

US Federal Reserve Interest Rate Decision

Focus will now shift to the Fed's remaining 2015 meetings in October and December. Whether the Fed chooses to act on rates this year or next, historically the correlation between Canadian and US long-term interest rates is very strong, even at times such as now when the two countries’ normally in sync monetary policy is heading in different directions. Therefore, as the Fed eventually moves to increase its target rate, there will likely be some upward pressure on 5-year interest rates in Canada. When paired with a recovering Canadian economy, this will likely translate to higher fixed mortgage rates by the middle of next year.

Wednesday, September 16, 2015

Canadian Manufacturing Sales

Tuesday, September 15, 2015

MORTGAGE RATES LOW AND STEADY

Friday, September 11, 2015

Vigorous Housing Demand Unabated in August

The British Columbia Real Estate Association (BCREA) reports that a total of 8,811 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in August, up 20 per cent from the same month last year. Total sales dollar volume was $5.5 billion, a 32.8 per cent increase in comparison to the previous year. The average MLS® residential price in the province rose to $619,881, up 10.6 per cent from August 2014.

“Housing demand continued at an elevated level in August,” said Cameron Muir, BCREA Chief Economist. “More homes were sold in BC during the first eight months of the year than in the entire 12 months of 2012.” A total of 67,637 residential transactions were recording in 2012, compared to 70,617 year-to-date in August.

“Many BC regions are now exhibiting sellers’ market conditions, with home prices rising well above the overall consumer price index,” added Muir. Eight of the 11 BC real estate boards recorded a higher average home price than a year ago.

The year-to-date, BC residential sales dollar volume increased 35.9 per cent to $44.3 billion, when compared with the same period in 2014. Residential unit sales climbed by 22.4 per cent to 70,617 units, while the average MLS® residential price was up 11.1 per cent to $627,008.

Copyright BCREA - reprinted with permission

Thursday, September 10, 2015

Best Rate Mortgage Rates - Dominion Lending

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||